The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has clarified that Nigeria’s new tax laws are designed to help, not harm, the aviation industry.

The clarification follows a Sunday interview on Arise News, where Chairman and CEO of Air Peace, Allen Onyema, sounded the alarm on the implications of the Nigeria Tax Act and related fiscal policies set to take effect in January 2026.

Onyema claimed that the laws reimpose a 7.5% Value Added Tax on aircraft imports, engines, and spare parts—charges previously suspended in 2020 amid the COVID-19 crisis, potentially pushing domestic economy class fares from current levels of around N350,000 to as high as N1.7 million.

In a statement via X on Monday, Oyedele acknowledged the challenges facing the sector, including multiple taxes, levies, and regulatory charges, noting that the committee has engaged extensively with airline operators.

Inside Kwara Community Where 60 Maidens Wed In One Day0:00 / 0:00

He, however, asserted that contrary to the claims circulating, the new laws are part of the solution, not the source of the problem.

“Contrary to the claim that the new tax laws will hurt the industry, the reform is part of the solution, not the source of the problem.

“Several long-standing tax issues driving costs in the sector have been resolved in the new tax laws or are being structurally addressed,” Oyedele said.

He highlighted key provisions of the law aimed at easing costs for airlines.

1.

The single biggest tax burden on airlines has been the 10 per cent withholding tax (WHT) on aircraft leases under the existing law. This has now been removed and replaced with a rate to be determined in a regulation, creating the legal basis for either a full exemption or a significantly lower rate.

To put this in context, on a $50 million aircraft lease, an airline currently pays $5 million in WHT, which is non-recoverable and therefore directly increases operating costs and strains cash flow. Eliminating this burden is a major structural relief for the sector.

2. –

While the temporary VAT suspension introduced in 2020 following COVID-19 was attractive, it came with a hidden cost. Airlines could not recover input VAT on non-exempt items, including certain assets, consumables, and overheads, meaning VAT became embedded in costs.

Under the new tax laws, airlines become fully VAT-neutral. Any VAT paid on imported or locally procured assets, consumables, and services will become fully claimable. Where an airline has excess input VAT, the law mandates a refund within 30 days, supported by a fully funded tax refund account and the option to offset VAT credits against other tax liabilities. This directly reduces cost pressure and improves liquidity.

3.

Existing exemptions on commercial aircraft, engines, and spare parts remain fully in place. There is no reversal or new burden introduced under the tax reforms.

4.

Airline operations are inherently low-margin. A 7.5 per cent VAT on tickets, within a system where input VAT is fully recoverable, results in a significantly lower net impact than the headline rate suggests. Even in a worst-case scenario where VAT were not claimable, the maximum impact would still be 7.5 per cent, not the price increases being suggested. That is, a N125,000 ticket becomes not more than N134,375 and a N350,000 ticket not more than N376,250.

5. ()

The new law provides a framework to reduce corporate income tax from 30 per cent to 25 per cent, which will benefit airlines. In addition, several earmarked profit-based levies, including Tertiary Education Tax, NASENI, NITDA and Police levies, have been harmonised into a single Development levy, reducing complexity and ensuring certainty.

6.

The multiplicity of levies imposed on airlines and flight tickets is real, but these charges are not created by the new tax laws. It is therefore incorrect to attribute them to the reform. The government is actively working with operators and relevant agencies to achieve a lasting solution. Importantly, the tax harmonisation provisions in the new laws mean the situation can only improve, not worsen, from 2026.

The statement concluded that the new tax laws provide a legal and policy framework to address long-standing challenges, reduce operating costs, and minimise impact on passengers.

It urged stakeholders to focus on engagement rather than unsubstantiated claims.

-Advertisement-

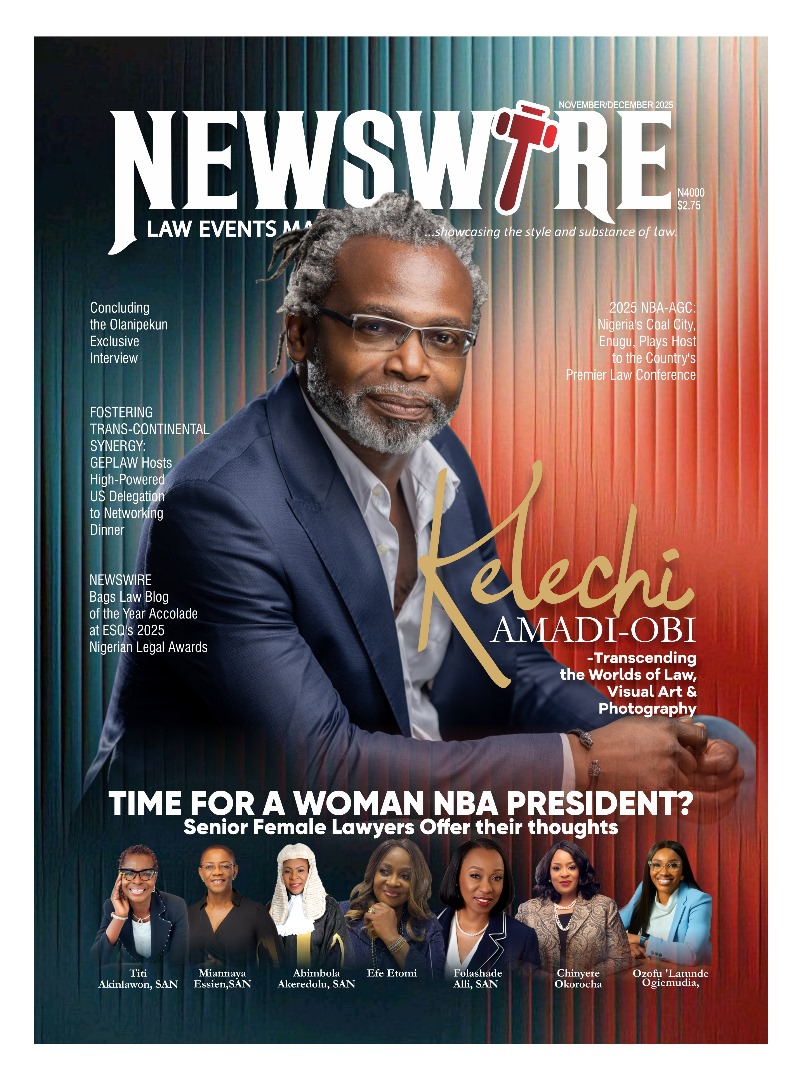

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk