Investing is a strategic approach to long-term financial stability, prosperity, and freedom. Investing is not just a good idea but a necessity that builds wealth and financial security.

For some first timer investors , you may be wondering where and how to start. You must be intentional and deliberate in making smart money choices that will ensure your money works and yields adequate return on investment.

The range of options are wide , below are my top three picks for first time investors

1. Treasury Bills

Treasury Bills are short term instruments issued by the Central Bank of Nigeria on behalf of the Federal Government at a discount. They do not yield any interest but are issued at a discount and repaid when they mature.

Why should I invest in treasury bills ?

- Treasury bills have relatively low-risk

- The interest received from treasury bills are not subject to tax.

- Repayment guaranteed at maturity.

- Can be used as collateral securities.

- Interest with the principal can be re-invested immediately.

2. Real Estate

Real estate remains one of the most popular investment options in Nigeria and for good reason. Property value is guaranteed to appreciate over time.

Why should I invest in real estate ?

- Real estate serves as a hedge against inflation, as property values tend to increase over time ,keeping pace with or outpacing inflation rates.

- Investors can generate regular rental income from tenants thereby providing a steady cash flow

- It can be used as collateral security

- It is tangible asset that holds value

Diversification benefits to investors, particularly in Nigeria, where other investment options may be subject to volatility and uncertainty.

3. Bond is a fixed-income instrument where individuals lend money to a government or company at a certain interest rate for an amount of time. The major difference between bond and treasury bill is that Treasury Bills are generally considered medium term investments, while Treasury Bonds are for long term.

Why should I invest in Bond ?

- Steady income: Bonds typically provide a fixed income source through periodic interest payments.

- Diversification: Bonds offer an opportunity to diversify an investor’s portfolio.

- Lower risk: They are less risky than equities since they have a higher priority of payment if the issuer defaults.

- Predictability: Bonds have a fixed term and interest rate, making them predictable investments. This predictability can be especially attractive for investors seeking a stable, low-risk investment.

What ever investment option you decide to go for , be sure to do your due diligence and ask the necessary questions before going ahead .

Do have a restful weekend and remember “A healthy lawyer is a happy lawyer, and a happy lawyer is a better lawyer.” – Unknown

so please make out time to relax , rest and rejuvenate .

Enjoy the rest of the weekend .

Ogechi Olisa-Mokelu

Partner , Eagles Height Attorneys

-Advertisement-

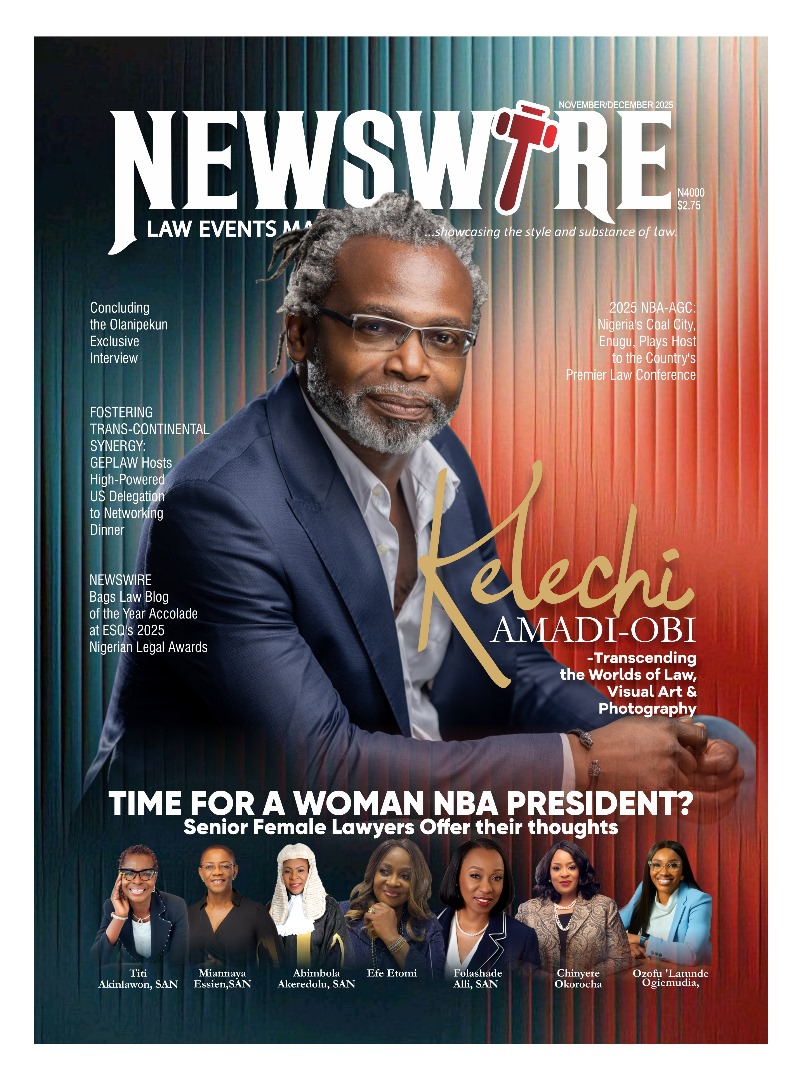

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk