The attention of the public has been drawn to the lingering dispute between the Ivorian oil giant, Societe Nationale Petroliere de Cote D’Ivoire (or PETROCI, which is the Ivorian equivalent of NNPC) and MRS Holdings, belonging to Sayyu Dantata.

This dispute has not dissipated even after the release of a final award/decision of the Arbitral Tribunal chosen by the parties, which was delivered on the 24th day of March 2021 and 21st of June 2021, respectively.

The crux of this dispute centres around the joint investments made by these two companies in MRS Oil Nigeria, Plc, a publicly-listed company. PETROCI had complained about having been excluded in the operations and management of MRS Oil, whereas the two joint venturers are supposed to jointly own and hold 60% of MRS Oil shares through a company described as MRS Africa Holdings, a wholly owned subsidiary of one Corlay Global SA, which the two co-investors registered in Panama.Given the recent indictments leveled at Oando (another major Nigerian Oil & Gas company) by the Nigerian market regulator, the Securities & Exchange Commission (SEC) leading to the suspension of trading in the shares and various negative outcomes for the companies and its investors, reports from concerned investors and the public suggest that this should not be a case that would be detrimental to the business and members of the investing public.

Although details of the pending formal petition filed by Petroci with authorities such as the Securities and Exchange Commission and the Corporate Affairs Commission, are still sketchy, it appears that, thanks to the international award confirming her 50 rights as a co-investor and orders to restructure the board and manage all subsidiaries of Corlay Global, PETROCI was scheduled to participate and have admitted on MRS Oil’s board, her proposed nominee directors in the persons of Dr. Ibrahima Diaby (DG of PETROCI), Inza Dosso (Managing Director, PETROCI) and a few prominent Nigerians. However, MRS Holding and MRS Oil is said to have again unilaterally shut her out from attending same despite physical presence of PETROCI’s representatives at the AGM venue.In the international arbitral proceedings between the parties, PETROCI alleged that MRS Holding has breached its right of information, its right to equal representation and its right to share the profits of the joint venture under the consortium agreement which caused PETROCI harm and loss through the deterioration of the accounts of the acquired subsidiaries.

PETROCI also alleged that MRS had breached its duty of reinforced cooperation under the consortium agreement. Hence, based on the agreement between parties as regards the mode of dispute resolution, PETROCI commenced arbitral proceedings against MRS.While affirming its defence against the claims, MRS made counter-claims against PETROCI, among them the allegation of failing to share equally all the acquisition costs in relation to the purchase of Chevron assets pursuant to an agreement which MRS claims exists between the parties.SUMMARYSometime in April 2008, both MRS and PETROCI received a notice of Expression of interest for the purchase of Chevron’s downstream distribution assets in West and Central Africa.

While PETROCI is a company registered under the laws of the Ivory Coast and known for handling upstream gas and oil activities. MRS, on the other hand is a Pan-African conglomerate of companies diversified in activities such as oil trading, shipping, storage, distribution and retailing of petroleum products.

Following the receipt of the Notice of Expression, both companies, in a bid to increase their chances of success in the acquisition of the controlling shares of Chevron Texaco downstream distribution assets in West Africa, created a Special Purpose Vehicle (SPV) called Corlay Global SA (“Corlay”).

The SPV was incorporated in Panama and capitalized for US $25m of 25 million shares of $1 each with both parties owning 50% equity in the company (i.e. each company owning 12.5 million Shares in Corlay) which was evidenced through the issuance of share certificates.Both entities, acting through Corlay, made a successful bid in the sum of US$675.8m for the acquisition of Chevron Texaco downstream distribution assets in West and Central Africa. Following that successful bid, they agreed to make equal equity contributions of $337.9m to make up the US$675.8m acquisition sum.

PETROCI made an initial contribution of $60m while MRS stated that it made an initial contribution of $75.8m, leaving a shortfall of about $540 m.As a result of the shortfall and PETROCI‘s inability to obtain finance from its local banks in Ivory Coast due to on-going civil unrest in the country at that time, it was agreed that MRS would obtain a bridge facility on behalf of both parties from the consortium of banks In Nigeria.

It was further agreed that the bridge facility will be in the name of MRS for the purchase of the CHEVRON/TEXACO assets, but the parties will jointly share responsibility to repay the loan on a 50:50 ratio. Pursuant to the foregoing also, PETROCI executed the guarantee security provided for the loan. In other words, although the loan was taken in the name of MRS, PETROCI was the sole guarantor.

Hence the acquisition sum was released by the local banks in Nigeria directly to CHEVRON/TEXACO on behalf of PETROCI and MRS, paving way for both entities through Corlay to acquire and takeover of five subsidiaries of Chevron Inc. in West and Central Africa (Chevron Cote d’lvoire, Chevron Togo, Chevron Benin, Chevron Cameroon, and Chevron Nigeria).Subsequently, PETROCI stated that to their surprise, Chevron Nigeria was unilaterally renamed as MRS Oil Nig. Plc by MRS without the consent of PETROCI – although some of the other subsidiaries like Chevron Cote D’Ivoire still retained the correct name of the holding company as Corlay Cote D’Ivoire.

In September 2008, as part of the acquisition process, a Share Purchase Agreement was entered into between Corlay Global SA, Chevron Africa Holdings Ltd, MRS and PETROCI in recognition of PETROCI and MRS as joint stakeholders/shareholders in Corlay Global. It is pertinent to note that PETROCI is a joint beneficial shareholder of the 100% interest of Chevron Africa Holding Ltd, that is 60% controlling shares in MRS Oil.

Unfortunately, about the time of the above successful acquisition, turbulent times existed in Cote D’Ivoire such that between 2008 and 2010, Ivory Coast was plagued by civil war. This naturally affected the management and administration of PETROCI, being a public enterprise and investment vehicle for the Ivorian Government. As a result of the foregoing, there was also no proper handover of management of PETROCI and necessary Information when Cote D’Ivoire began to return to some level of normalcy.

It was only when AMCON sued PETROCI based on PETROCI’s sole guarantee of the share purchase loan that PETROCI commenced investigation to trace back the status of its investment in Corlay which has assets in Nigeria by way of Corlay’s investment in MRS Oil.PETROCI then began to investigate MRS independently regarding its stewardship over the existing SPV Corlay Global S.A in Panama and the various subsidiaries in West and Central Africa.

PETROCI at that same time also directly started making series of enquiry at MRS Oil and MRS Holding and requesting for necessary information and accounts of its management of their joint investment in subsidiaries of Corlay in west and central Africa. PETROCI also reviewed publicly available financial statement of MRS Oil, following MRS Oil and MRS Holding’s deliberate refusal to cooperate.

Upon investigation, PETROCI stated that they discovered deliberate concealment and misrepresentation of corporate and other essential information incompatible with the standards of financial reporting, as MRS failed to disclose corporate information required to be filed by public companies under the Investments and Securities Act, 2007 and mother 5 extant Rules and Regulations. Furthermore, PETROCI stated that its Interest was deliberately concealed and even converted in the face of the financials of MRS Oil as a listed company in Nigeria.

Also, the board composition and management team did not reflect the constituent shareholders of Corlay as PETROCI is 50% shareholder of Corlay and did not have any representation on the board of MRS Oil.PETROCI added that in the same vein, the financial statements of MRS Oil carefully concealed the true ownership of the company by Corlay (the investment vehicle by which PETROCI and MRS directly controls 60% of the shares of MRS Oil).

Also, the board of directors of MRS Oil as procured by MRS Holding, falsely misstated the Interest of Corlay in MRS Oil was now held by MRS Africa Holding Limited. PETROCI stated that it did not agree or consent to any such transfer of Corlay’s interest in MRS Oil to MRS Afrlca Holding Limited. By extension, no shareholders meeting of Corlay has been summoned or held to approve any such sale or transfer and no notice of any such meeting was served or received by PETROCI. Moreso, PETROCI stated that the financial statements also show that dividends have been declared over the years by the board and AGM of MRS Oil and paid to shareholders, but Corlay has received no dividend though declared from 2010 to 2014.MRS Oil, in response, claimed that PETROCI failed to share equally all the acquisition costs in relation to the purchase of Chevron assets pursuant to an agreement.

Based on the above, it is evident that a dispute had arose from claim of breach of the Consortium Agreement entered into by PETROCI and MRS OIl which was for the purpose of floating a Special Purpose Investment Vehicle (SPV) to be known as Corlay Global. Interestingly, Clause 17 of the Consortium Agreement provides that “in the event of a dispute between or amongst the parties on their rights and duties under the terms of the agreement, or of any element introduced in pursuit of the activities of the Consortium, the dispute shall be referred to and determined by the Court of Arbitration of Paris.”Consequent upon the arbitration agreement, arbitration proceedings(La Societe Nationale D’Operations Petrolieres De Cote D’Ivoire (“Petroci”) and MRS Holdings Ltd in ICC Case No. 23221/DDA (c-23222/DDA) was thus commenced in Paris, France consisting essentially on the one hand of an arbitral claim by Petroci of the breach of the terms of the Consortium agreement by MRS (particularly but not limited to the MRS’s obligation to recognize Petroci’s right to 50% acquisition and operation rights in all the subsidiaries of the Corlay Group holding the Chevron downstream assets acquired, and financial damages arising from exclusion and negation of said rights), and on the other hand by MRS’s financial counterclaim for obligation to pay acquisition costs.

Upon filing of the parties’ closing submissions, the arbitral tribunal comprising of Prof. Dr. Maxi Scherer, Dr. Hami Gharavi and Mr. Michael Young QC after hearing the parties on the issues in contention delivered its Final Award on the 24th day of March 2021. DECISION OF THE TRIBUNALThe Arbitral Tribunal by the aforesaid Final Award contained at Page 271 of the Award ordered that PETROCI has a 50% stake in Corlay Global and its subsidiaries, including MRS Africa Holdings.

The tribunal also ordered that MRS is to call a general meeting of all Corlay entities within 30 days of the Award (March 24 2021) for the termination of the mandate of current directors and the appointment of new board members, with each party having the power to appoint equal numbers of directors.Furthermore, damages of US$25,496,56 is to be paid to Petroci by MRS with 10% interest from December 31 2018, while Petroci is to pay the sum of US$34,029,629 to MRS with 10% interest from November 14 2017, as acquisition costs. .AFTERMATH OF THE FINAL AWARDIndeed, MRS Oil wrote to PETROCI on April 2, 2021 demanding for payment albeit PETROCI had forthwith applied for a correction of the Award.

During PETROCI’s review of the final award, it was noted that the arbitral tribunal had made an error in the computation of the acquisition costs payable by it to MRS, which error unwittingly had put PETROCI in a debit position on a net basis.

Consequent to the above, the PETROCI applied to the arbitral tribunal for the rectification of the arbitral award dated the 24th of March 2021, to which the tribunal vide an addendum acknowledged the error made and rectified the erring paragraph in relation to the financial aspect of the award.By the said Addendum, the PETROCI is to pay MRS the sum of USD 14, 413,697.50 as the unpaid balance of its 50% of the acquisition costs as opposed to the sum of USD 34,029,629 wrongly calculated in the final award.

Consequently, a deduction of the amount due from PETROCI under the addendum from the amount due from MRS under the Final award stands at the sum of USD11,082,862.5 in favour of PETROCI.

According to PETROCI, it had since April 14, 2021 served MRS with a letter demanding the execution of the distinct reliefs of Tribunal ordered Annual General Meetings for equal restructuring of representation on the board of all the member companies of the Corlay Global Group of companies in the various countries by virtue of the recognition of PETROCI’s right as a 50% shareholder.

However, MRS responded stating that the application for correction does not entitle Petroci to withhold the payment under the Award but conceded that she (MRS) would respond on the status of the meeting as ordered by the Tribunal.

Although MRS, in apparent compliance with the Award issued notices of Annual General and or Shareholders meeting, PETROCI stated, however, that on all the mentioned dates, its representatives were at the relevant venues to attend each of the Shareholders’ Meeting slated in line with the Arbitral Award but none of the meetings was complied with by MRS as PETROCI was informed in each case at the venue of the cancellation of these duly-convened meetings.

Following the Addendum Award correcting the position on the financial net position between the parties, PETROCI made a formal demand for payment of USD 12,200,000 (Twelve Million Two Hundred Thousand Dollars) inclusive of 10% interest per annum as 24th June 2021.

However according to PETROCI, despite the above demand on the financial award in the Addendum, and the earlier demand in relation to implementation of the recognition of its 50% shareholder right with resulting shareholders meeting to restructure all the boards of the subsidiaries, MRS has failed and or neglected to comply with the decision of the Tribunal as contained in the Final Award and its addendum both dated 24th day of March 2021 and 21st day of June2021 respectively.

This is the present status of the matter. We will continue to update relevant stakeholders and the public on the progress of the ongoing dispute.

-Advertisement-

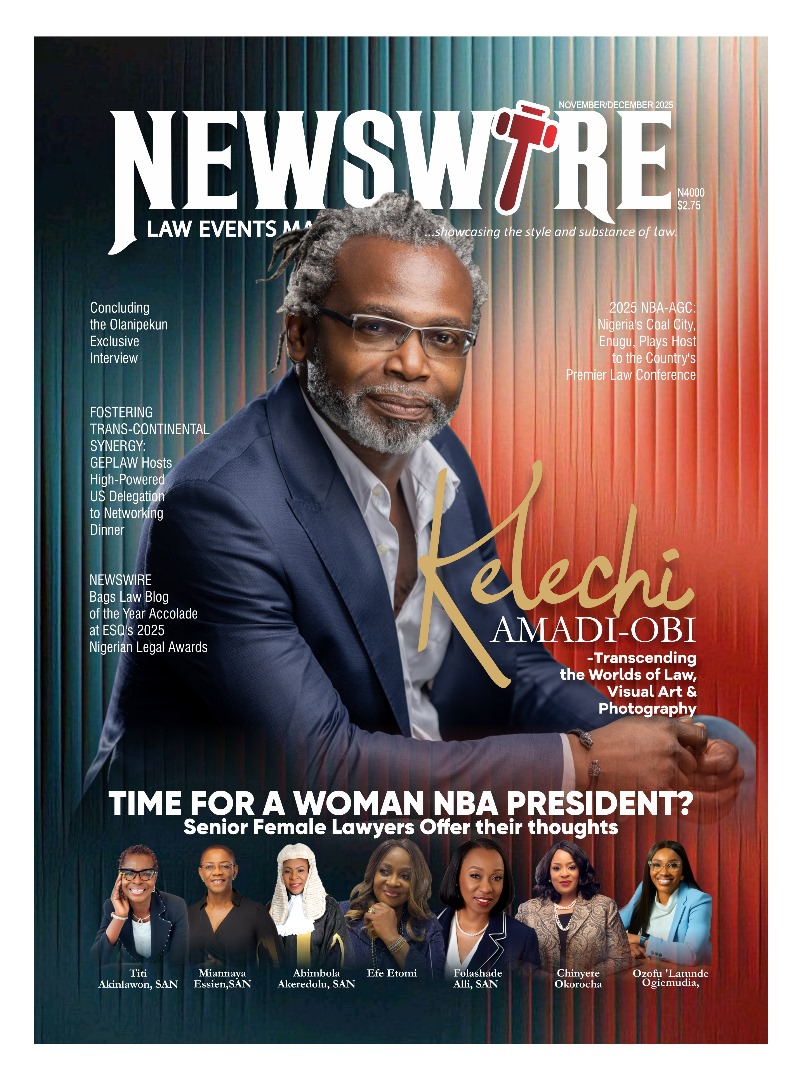

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk