The Chairman of the Chartered Institute of Taxation of Nigeria, Abuja District, Ben Enamudu, has dismissed claims that bank balances are taxed under Nigeria’s new tax regime, saying only certain electronic transfers attract a ₦50 stamp duty and that the reforms are designed to shield low-income earners.Speaking in an interview with ARISE News on Tuesday, Enamudu said misinformation about the reforms—particularly around bank transfers and income thresholds—has caused undue concern among Nigerians.

“The narrative out there, which is the wrong narrative, is that the money in your bank account will be taxed. There is no provision for that in our tax laws. Nobody taxes the money in your bank account,” he said.He explained that the charge applicable to electronic transfers is a stamp duty, not a tax on deposits or account balances.

When you make transfers from your account to someone else, there is a ₦50 stamp duty that applies. However, if you maintain multiple accounts within the same bank, you are not expected to pay the stamp duty,” Enamudu said.

According to him, the reform also changes who bears the cost of the duty.

“Before now, both the sender and the receiver bore the burden of the stamp duty. But with the new tax reform, only the sender pays,” he said.Enamudu said several transactions are exempt from the charge.

“Salary accounts and payment of salaries are exempted from stamp duty. Transfers below ₦10,000 are also exempted. Once it hits ₦10,000, you pay the ₦50 charge,” he said.

He added that transfers between personal accounts held in different banks still attract stamp duty.Once it crosses one financial institution to another, the stamp duty is triggered, even if it is your own account,” he said.

Enamudu also noted that essential goods and services remain exempt from value-added tax.

“You don’t pay VAT on basic food items, medicals, pharmaceuticals, education and other essentials,” he said.

On housing, he highlighted a rent relief introduced under the reforms

-Advertisement-

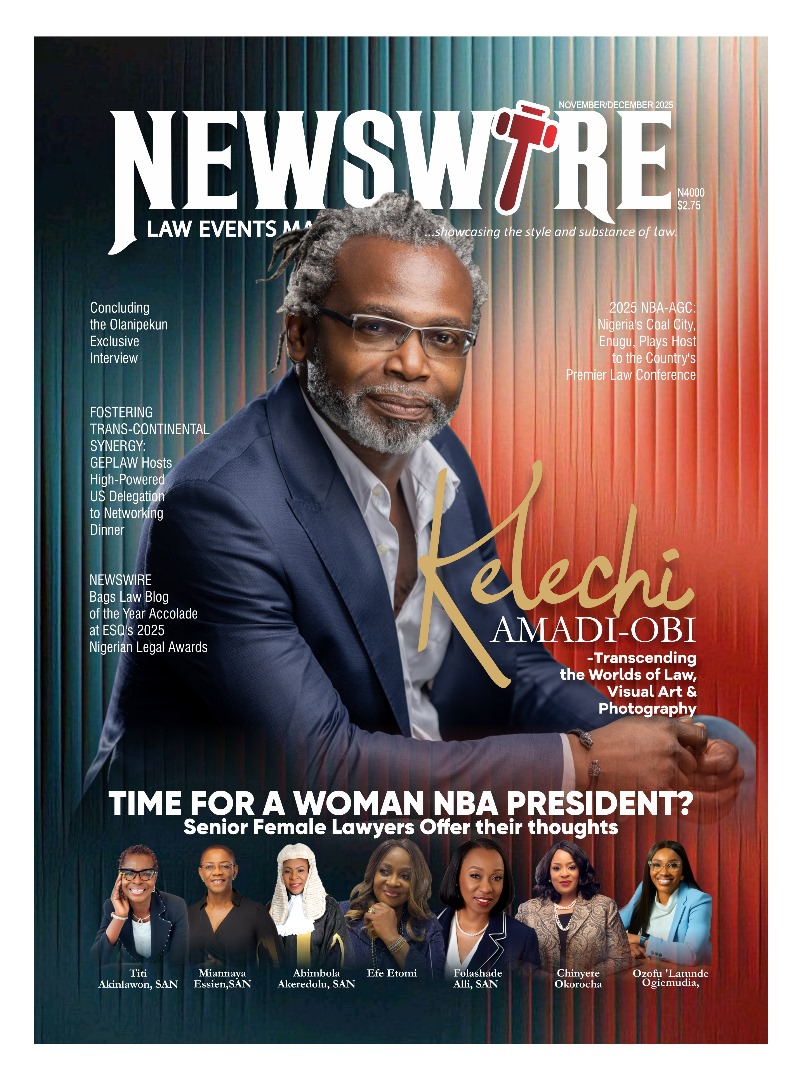

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk