The National Assembly has formally transmitted the tax reform bills to President Bola Tinubu, marking a critical step in the administration’s ambitious fiscal overhaul under the Renewed Hope agenda.

The Chairman of the Senate Committee on Media and Public Affairs, Senator Yemi Adaramodu, confirmed the development during a press briefing at the National Assembly Complex on Tuesday.

He disclosed that the harmonisation process between the Senate and the House of Representatives had been completed.

“Yes, the bill has now been transmitted. It is out of our hands and on its way to the executive,” Adaramodu stated.

The legislative package includes the Joint Revenue Board (Establishment) Bill, the Nigeria Revenue Service (Establishment) Bill, the Nigeria Tax Administration Bill, and the Nigeria Tax Bill.

All four are designed to modernise tax collection, expand the tax base, and improve inter-governmental coordination—core pillars of Tinubu’s economic reform strategy.

The bills, first submitted in November 2024, were passed by both chambers after months of debate, revisions, and intense behind-the-scenes negotiations.

Adaramodu said the lengthy legislative process was deliberate and necessary.

“Tax bills like these require scrutiny. Legal departments in both chambers must ensure they align with existing laws before we send them to the Presidency.

“It’s not a matter of two or three days,” he said, detailing the stages involving joint committees, aggregators, and legal review teams.

“After harmonisation, the Clerk of the National Assembly prepares the final document. Only then can the Senate President and the Speaker sign off for transmission,” he added.

Just a week earlier, the Senate President, Godswill Akpabio, had credited the eventual approval of the bills to “national interest, inclusive legislative engagement, and strategic leadership.”

One of the most contentious provisions was the initial proposal to allow tax-generating states to retain 60 per cent of Value Added Tax revenue—a clause that drew strong opposition, particularly from lawmakers in the North who feared it would economically sideline their region.

The Senate ultimately negotiated a middle ground, slashing the retention rate to 30 per cent and replacing the politically sensitive term “derivation” with “place of consumption” to ensure consensus.

-Advertisement-

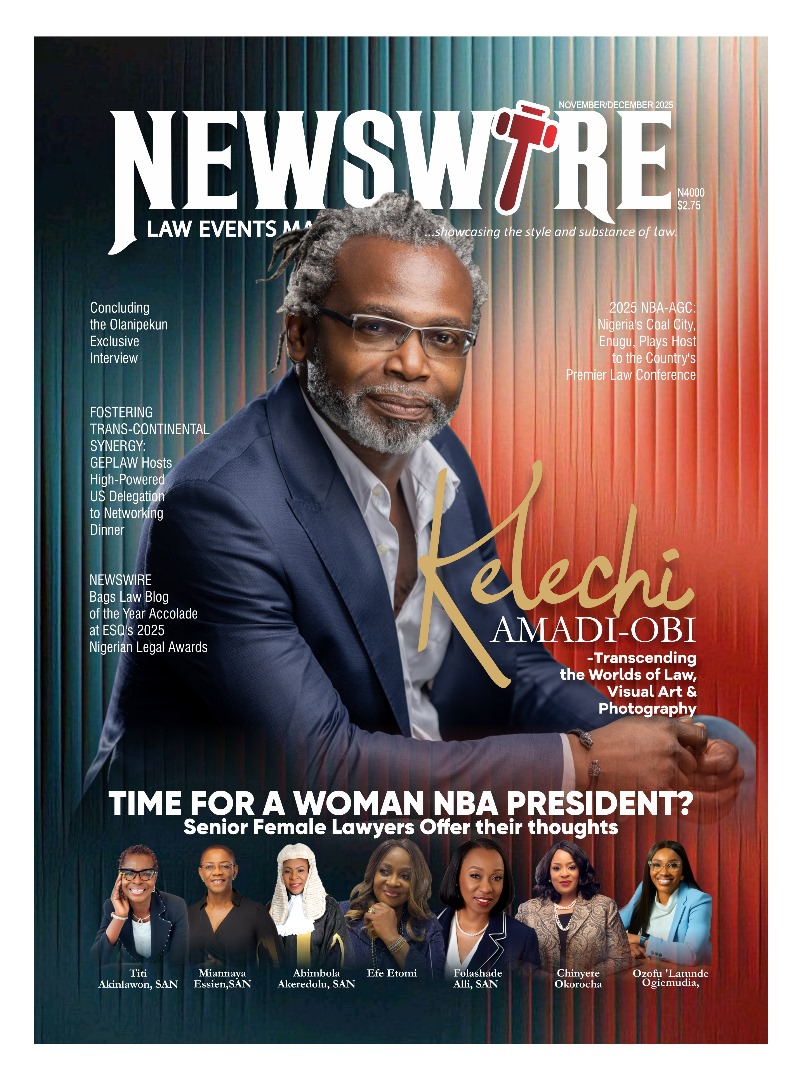

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk