Nigeria’s private sector grappled with heightened inflationary pressures in November 2024, driven by currency depreciation and escalating fuel prices, according to the latest Purchasing Managers’ Index report by S&P Global.

The report, released on Monday, revealed that these factors significantly increased input costs, restricted purchasing activities, and dampened growth across various sectors.

The PMI for November stood at 49.6, indicating a marginal decline in private-sector activity compared to October’s 46.9. While there was a slight recovery in new orders and a softer contraction in output, steep price pressures continued to challenge businesses.

“The less pronounced deterioration in business conditions partly reflected a renewed expansion in new orders, though elevated prices still deterred many customers,” the report noted.

Employment levels also fell for the first time in seven months, marking the end of a modest period of job creation.

“The decline in staffing was most notable in the services sector, as businesses faced difficulties sustaining operations under the weight of rising costs. The inflationary environment has created significant strain for businesses, with some unable to maintain workforce levels,” the report added.

Sector data painted a mixed picture. While agriculture and manufacturing recorded output growth, the wholesale, retail, and services sectors suffered declines.

Businesses reported sharp increases in purchase costs, attributed to higher fuel and raw material prices alongside the continued weakening of the naira.

The report further said, “Input costs are rising at an alarming rate, forcing us to make tough decisions to stay afloat.”

Staff costs also surged as companies offered additional support for employees grappling with higher transportation and living expenses.

To offset rising input costs, businesses increased output prices significantly, exacerbating the muted demand environment. Many firms cut back on purchasing activities and inventories, while some scaled down operations entirely.

Despite the challenges, some firms remained optimistic. “We are hopeful that strategic investments and planned expansions will position us better for the coming months,” the report quoted a business owner.

However, the report noted record-low business confidence, underscoring lingering concerns about inflationary pressures and uncertain economic conditions.

On a positive note, supplier delivery times improved, aided by smoother road conditions, prompt payments, and competitive vendor dynamics. Yet, these gains offered little relief against the broader challenges facing Nigeria’s private sector.

“The path to recovery will require addressing structural issues like currency instability and rising energy costs,” the report stressed.

-Advertisement-

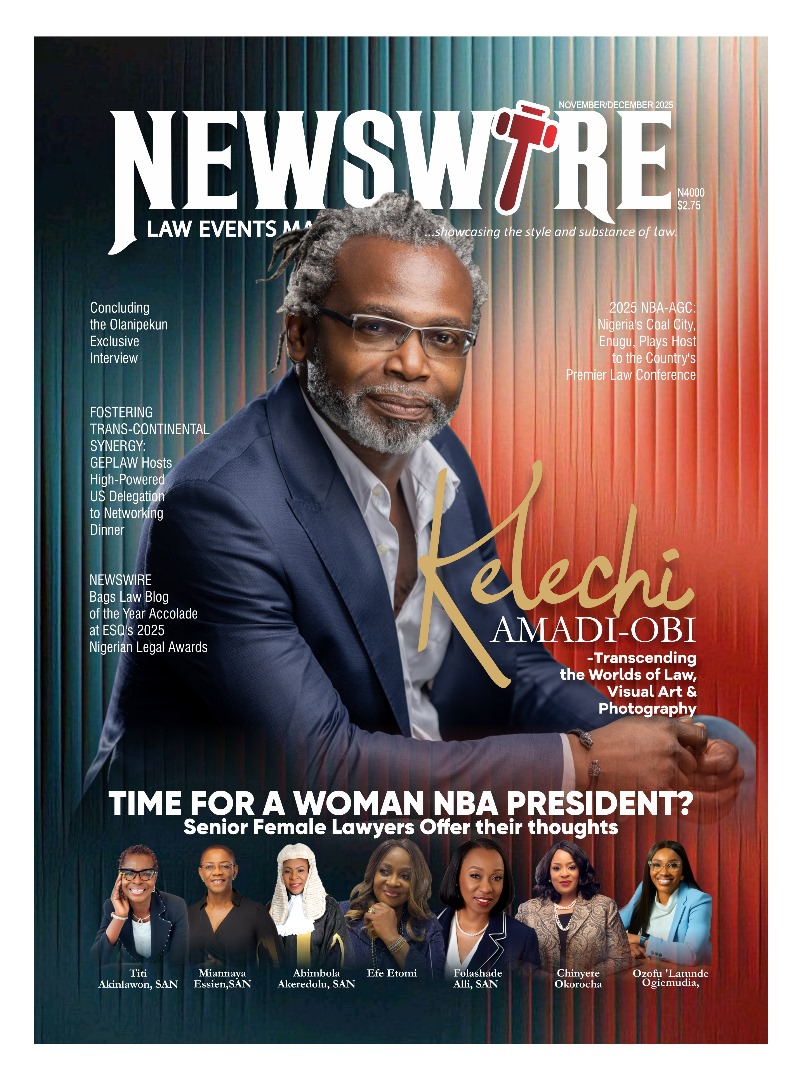

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk