The Federal Government has reassured citizens and investors that the implementation of the new tax laws will be done fairly, transparently, and with a human face.

The Chairman of the National Tax Policy Implementation Committee, Mr Joseph Tegbe, gave the assurance after the committee was inaugurated by the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, in Abuja on Friday.

Tegbe said fears that the reforms would lead to intrusion into personal bank accounts were unfounded, stressing that there would be no encroachment and no investigations targeted at ordinary Nigerians.

“Government is not going to encroach into their personal accounts. Nigerians are not under probe or investigation,” he said, repeating that the administration had no interest in “irresponsibly encroaching on personal bank accounts of citizens or residents in Nigeria.”

According to him, the reforms are designed to support economic stability, improve revenue, and protect vulnerable groups. He said January 1 remained the start date, but the government would not implement anything that would harm the economy.

“We want to assure Nigerians, especially those foreign and local investors, that on January 1, we will not implement anything that is going to be destructive to the economy. There will be no surprises. Some of those areas of concern will be addressed. The systems that we are building will respect legitimate expectations, reduce uncertainty, and protect the most vulnerable,” he stated.

Tegbe noted that the committee had been set up to ensure wide consultation and collaboration. “We want to ensure that all stakeholders are aware and have fair buy-in and ownership of whatever they implement. So we will meet widely, both businesses, subnational governments, civil societies, and also professional bodies,” he said.

He added that the programme would be one of the most important undertakings of the administration, saying that consultation and refinement would run alongside implementation. He acknowledged that concerns existed over some provisions, particularly the capital gains tax.

“One of those areas is capital gains tax. We will ensure that we are fully engaged and ensure that whatever resolutions are done actually take into consideration the concerns that have been expressed,” he said, adding that the issue had triggered volatility in the stock market until the Minister of Finance intervened.

He hinted that some parts of the law could be reviewed before the effective date. “Inasmuch as we are going ahead with January 1, there might be some provisions that we will need to take a second look at before then. Some of the things you will hear in the next few days are that there might be areas where the status quo might be maintained,” he added.

Tegbe said that tax reforms were not only about levies and duties but also about incentives that encourage investment. “Sometimes taxes are about creating the right environment for investment. So when you create taxes, you also have incentives. Under the Act, it’s not all about taxes and duties; there are incentives. And that’s what’s most important for us. Those incentives that will encourage investment, both foreign and local investments,” he explained.

He also highlighted provisions intended to protect low-income earners. He said President Bola Tinubu’s administration wanted to ensure that Nigerians earning lower income were exempted from tax as much as possible and that the widened tax bands would be retained.

“We will not lose that benefit,” he said, stressing that the government would not reverse gains made in improving relief for low earners.

Tegbe maintained that the implementation would be responsible and humane. “If well executed, and we intend for that to happen, Nigerians will experience improved revenue mobilisation, reduced leakages, and a more stable and competitive economic environment, and we will work with everybody to ensure that partnership with stakeholders happens in implementing these long-term reforms.”

He said structures were being deployed to address sensitive areas and noted that concerns would continue to be reviewed.

“As you are implementing, you are learning, you are refining,” he said. He added that areas linked to pioneer status would also be examined. This is a very sensitive government. It’s a responsive government and a responsible government. We would ensure that those areas are addressed,” he stated.

The National Tax Policy Implementation Committee was inaugurated on November 28, 2025, when Bola Tinubu approved its formation. The committee, chaired by Joseph Tegbe, is tasked with overseeing the coordinated rollout of the new tax laws across Nigeria.

-Advertisement-

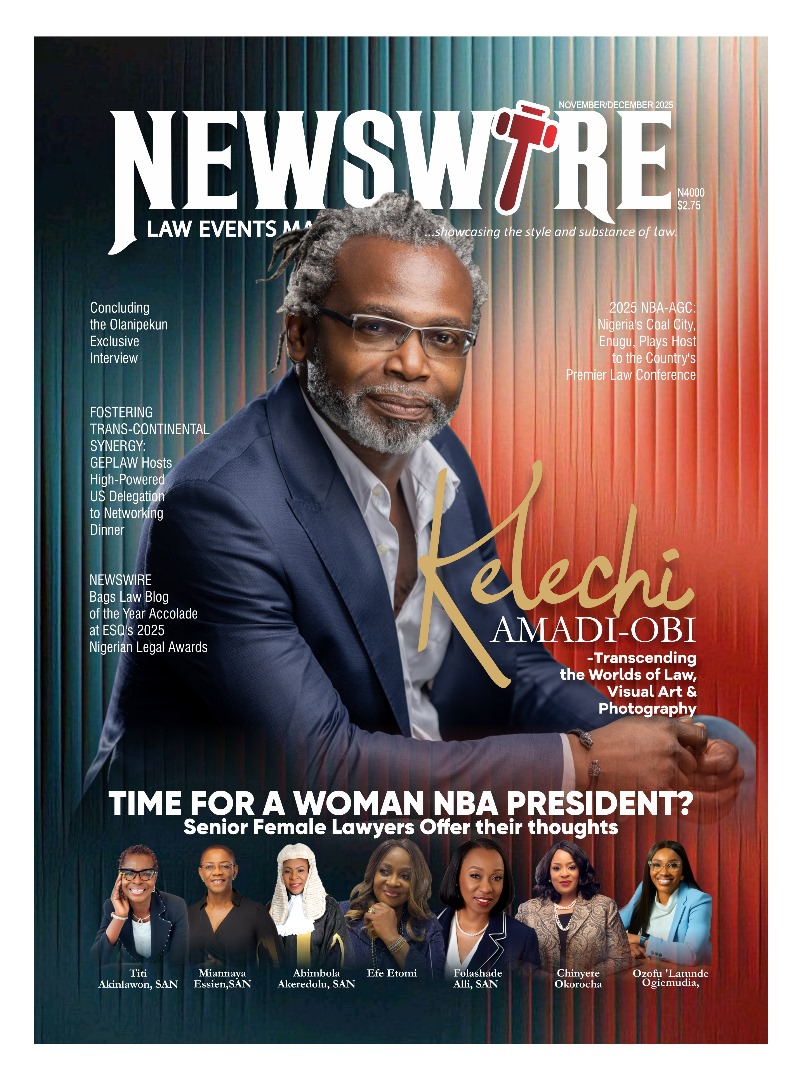

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk