The Federal Inland Revenue Service (FIRS) has urged the federal high court in Abuja to reject an application by Binance Holdings Limited to nullify an earlier order allowing the tax agency to serve court documents via email.

The development comes amid a $79.5 billion tax case filed by the FIRS against the cryptocurrency exchange and two of its executives — Tigran Gambaryan and Nadeem Anjarwalla — for allegedly operating without proper tax compliance in Nigeria.

Inyang Ekwo, the leading judge, had on February 11 granted FIRS leave to serve originating summons on Binance through substituted means, specifically via the email address of the firm’s general counsel, Eleanor Hughes.

However, Binance, through its lawyer Chukwuka Ikwuazom, SAN, filed a motion on April 4, arguing that the service was defective and should be set aside.

The company contended that under court rules, substituted service cannot be applied to companies outside Nigeria without strict compliance with procedures for serving entities beyond its jurisdiction.

“By the rules of this Honourable Court, service outside jurisdiction must comply with Order 6, Rule 18 or Rule 20,” Ikwuazom said.

He insisted that FIRS failed to secure the court’s leave to serve outside its jurisdiction and did not meet the threshold for substituted service.

The crypto firm, registered in the Cayman Islands according to its counsel, argued that the email-based service was improper and invalid.

But FIRS, represented by senior lawyer Kanu Agabi, SAN, countered the claims in an affidavit deposed to by Ishaya Isuwa, a litigation officer with the agency.

‘BINANCE’S CLAIM OF BEING REGISTERED IN CAYMAN ISLANDS FALSE’

Isuwa said Binance’s claim of being registered in the Cayman Islands was “false and concocted,” adding that the company had not produced any registration certificate to support its assertions.

He also said Binance has a “significant economic presence” in Nigeria and that Eleanor Hughes, the email recipient of the court documents, is a principal officer of the company who has actively engaged with Nigerian authorities, including the Economic and Financial Crimes Commission (EFCC).

The litigation officer further explained that efforts to serve the documents on Tigran Gambaryan while he was in Kuje Correctional Centre were thwarted, with the Binance representative directing that the law firm of Aluko & Oyebode should be served instead.

However, the firm declined the documents, saying it had not been formally briefed by Binance at the time.

Isuwa maintained that Hughes’ prior engagement with Nigerian authorities and her legal representation of Binance make the substituted service valid and effective.

“Service of the originating processes on the 1st defendant/applicant through Eleanor Hughes is good service in accordance with rules of this honourable court,” he said.

At the court sitting on Wednesday, Ikwuazom told the court the case was listed for the hearing of their motion filed on April 4 and also moved a motion for an extension of time to regularise their filings.

The extension was granted without objection from FIRS.

Agabi said he would respond to the substantive motion in due course.

Ekwo, therefore, adjourned the case until May 12 for a hearing.

It was earlier reported that the FIRS filed the $79.5 billion suit against Binance over alleged tax evasion between 2022 and 2023.

The agency seeks judicial affirmation that Binance is liable to corporate income tax under Nigeria’s Significant Economic Presence (SEP) regulations.

EFCC had also filed separate charges of money laundering against the firm and its executives.

Justice Emeka Nwite had in October 2024 discharged Gambaryan after the EFCC withdrew its case, while Anjarwalla, who was detained alongside him, escaped custody in March 2024.

-Advertisement-

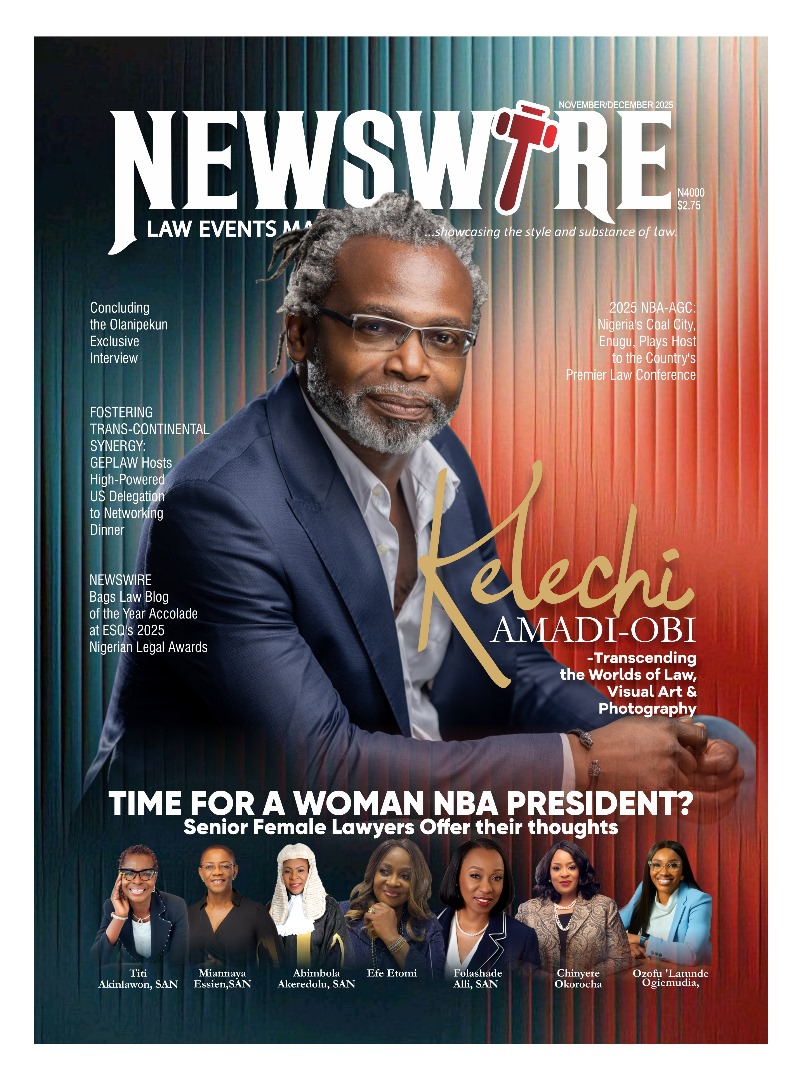

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk