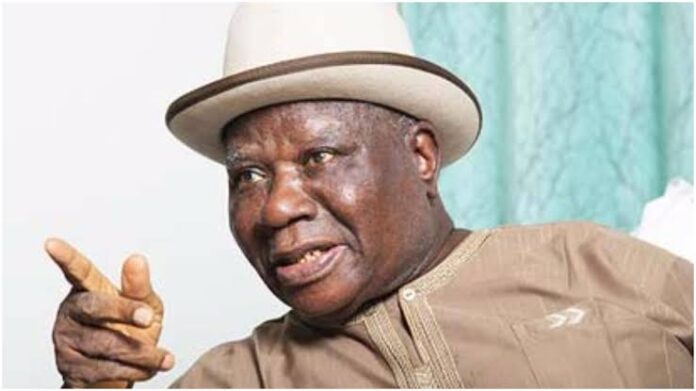

Former Federal Commissioner for Information and South-South Leader, Chief Edwin Clark, has raised concerns about Nigeria’s tax system, urging that the design of the tax framework prioritize incentives for collection and central remittance, rather than emphasizing revenue sharing fairness.

In a statement issued in Abuja, Clark, also the Leader of the Pan Niger Delta Forum (PANDEF), expressed his position on the controversial tax reforms presented before the National Assembly by President Bola Tinubu. Clark emphasized that focusing on equitable revenue sharing, without improving collection mechanisms, could create adverse incentives, as states would only be able to share what is collected.

The elder statesman underscored that improving tax collection and remittance processes should be the priority to ensure a social contract between corporations and individuals. He stressed the importance of enhancing sub-sovereign capacities to collect taxes.

Clark called on President Tinubu and the 19 Northern Governors to handle the tax reform issue with caution, warning that failure to do so could lead to unfavorable consequences for the nation.

The leader of the Southern and Middle Belt Leaders’ Forum (SMBLF) also pointed out that restructuring Nigeria’s fiscal federalism could pave the way for overhauling the tax system. He stated, “The ongoing controversies surrounding the tax reforms highlight the need for a full and comprehensive constitutional review. This review should address equitable revenue sharing and develop a transparent formula that considers both the needs of less economically advantaged states and the contributions of higher-revenue generating states.”

Clark further emphasized the necessity of political consensus building to ensure that tax reforms have broad-based support and are sustainable across political transitions. He argued that restructuring is essential for unity in Nigeria, noting, “If we must live together as one country, restructuring is a sine qua non.”

He added, “We can no longer tinker around the edges. The design of Nigeria’s tax system must prioritize incentives for collection and central remittance rather than focusing solely on fairness in revenue sharing.”

Clark also reflected on Nigeria’s history and the importance of equitable resource distribution. He recounted past grievances, including the resistance to taxes by various groups such as the Aba Women’s Riot of 1929, and the tax protests led by Funmilayo Ransom-Kuti in the West.

In his call for national unity, Clark urged that Nigeria’s leadership must manage its diversity, warning that failure to do so could perpetuate inequality and injustice. He pointed out that despite the Niger Delta region’s significant contribution to Nigeria’s oil revenue, the region remains marginalized and deprived of benefits.

In conclusion, Clark reiterated the need for Nigeria to restructure its systems to ensure that all regions have equal opportunities, saying, “We must restructure this country. The inequality, injustice, and oppression based on tribe and region will continue if we don’t address it.” He lamented that nepotism has taken root in Nigerian politics, with political appointments disproportionately favoring certain regions.

Clark’s statement came in response to the four tax reform bills transmitted to the National Assembly by President Tinubu on October 3, 2024, as part of the Presidential Committee on Fiscal and Tax Reforms’ recommendations. These bills include the Nigeria Tax Bill 2024, the Tax Administration Bill, the Nigeria Revenue Service Establishment Bill, and the Joint Revenue Board Establishment Bill.

-Advertisement-

Grab our latest Magazine, "Hon. Chief C.O.C Akaolisa gets justice". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did