The price of Nigeria’s Bonny Light has risen to $70 per barrel from $68 per barrel due to a drop in oil inventories in the United States.

This increase follows a recent trend where the United States has exported crude oil to Nigeria while importing petroleum products from the Dangote Petroleum Refinery.

According to the United States Energy Information Administration’s September Short-Term Energy Outlook, U.S. total distillate inventories are forecast to end 2025 and 2026 at lower levels than in previous years.

This forecast, coupled with speculation, has driven crude prices up globally, with Bonny Light and Brent crude reaching $70 and $69 per barrel, respectively.

Despite the price increase, Nigeria’s crude oil price remains below the $ 75-per-barrel benchmark set in the nation’s 2025 budget.

The budget also assumes a production level of 2.06 million barrels per day and an exchange rate of N1,500 per $1.

The U.S. Energy Information Administration report noted that while U.S. distillate inventories have increased since the forecast’s publication, they remain relatively low.

The report highlighted that lower distillate inventories increase the risk of price volatility, particularly during periods of high demand.

The report stated: “In the weeks since the publication of this forecast, U.S. distillate inventories have increased substantially, but they remain relatively low. Distillate fuel oil includes both diesel fuel used in vehicles and home heating oil.

“Lower distillate inventories elevate the risk of higher prices and price volatility from supply disruptions, especially during periods of high demand like the autumn harvest and winter heating season.

“We use total distillate to look at the combination of distillate fuel oil and biomass-based distillate fuel oil, which can be used in place of distillate fuel oil and includes both renewable diesel and biodiesel.

“A significant factor in the forecast low inventories is the sharp inventory drawdown in the first half of 2025 (1H25). U.S. total distillate inventories decreased by 17% (about 22 million barrels) during this period, more than the average decrease of 10% (14 million barrels) over the same period in the previous four years.

“One major reason for the large inventory draw in 1H25 was the reduced supply of renewable diesel and biodiesel because of lower production and lower net imports of those fuels. A less renewable diesel and biodiesel supply resulted in more demand for petroleum-based distillate to fill the gap.

“As renewable diesel and biodiesel consumption decreased by 124,000 barrels per day (b/d), or 35%, in 1H25 compared with 1H24, petroleum distillate fuel oil consumption increased by about 170,000 b/d, or 5%.

“We expect the 1H25 drop in biofuels consumption to be a short-term departure from the longer-term trend of biofuels increasing as a share of distillate consumption. We forecast renewable diesel and biodiesel consumption to partially recover in the second half of 2025 to meet existing and future production mandates under the Renewable Fuel Standard (RFS).”

-Advertisement-

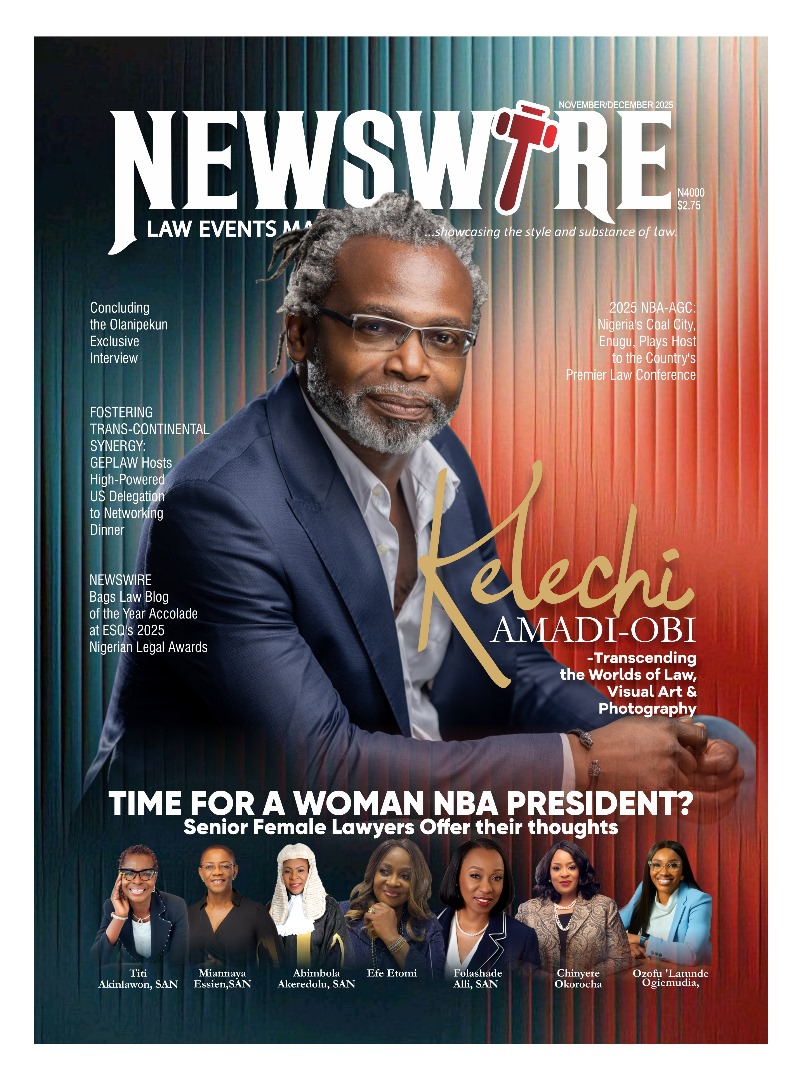

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk