The Chief Justice of Nigeria (CJN), Hon. Justice Kudirat Olatokunbo Kekere-Ekun, has called on Nigerian judicial officers to remain proactive and informed on emerging financial innovations—especially cryptocurrency and decentralised finance (DeFi)—to effectively manage the growing legal complexities in the sector.

She also lauded the Nigeria Deposit Insurance Corporation (NDIC) for its foresight in safeguarding the country’s financial system.

Speaking through Justice Inyang Okoro at the opening ceremony of the 2025 Sensitisation Seminar organised for Judges of the National Industrial Court of Nigeria and members of the Investment and Securities Tribunal (IST), the CJN emphasised the critical role of a robust deposit insurance framework. The seminar was organised by the NDIC in collaboration with the National Judicial Institute (NJI).

Justice Kekere-Ekun, who also chairs the NJI Board of Governors, highlighted the importance of a stable financial sector to Nigeria’s economic prosperity, noting that an effective deposit insurance mechanism builds depositor confidence, reduces risk, and ensures orderly resolution of bank failures.

“The financial sector is the lifeblood of any nation’s economy. A stable and resilient financial system is fundamental to economic prosperity, and at the heart of this stability lies an effective deposit insurance mechanism,” she said.

Citing the seminar’s theme, “Strengthening Adjudication and Depositor Confidence in the Banking System,” she urged judicial officers to be well-versed in financial law, regulatory policies, and global best practices.

“The courts serve as the final arbiters in financial disputes. Complexities in banking litigation—ranging from insolvency to regulatory interventions—demand a judiciary that understands the nuances of financial laws and deposit insurance. Our rulings have far-reaching implications on investor confidence, financial inclusion, and economic growth,” she added.

She further commended the NDIC for its timely interventions and risk management strategies, especially following the recent resolution of Heritage Bank, which she described as consistent with the Corporation’s commitment to excellence.

Earlier, the Acting Managing Director/Chief Executive Officer of NDIC, Mrs Emily Osuji, noted in her welcome address that the seminar was designed to enhance collaboration and build the capacity of judges who adjudicate cases involving failed financial institutions.

“Deposit insurance has become an increasingly important feature of financial safety nets globally. The Corporation provides both financial and technical assistance to eligible failing or failed insured institutions,” Osuji explained.

She disclosed that the NDIC, in partnership with the Central Bank of Nigeria (CBN), continues to achieve major milestones, particularly the orderly closure of Heritage Bank. Osuji, however, raised concerns about ongoing legal actions against failed banks and the NDIC, despite statutory protections.

“The Honourable Chief Judge has graciously issued Winding Up Rules and Practice Directions for bank liquidation pursuant to Section 56 of the NDIC Act 2023, though the gazetting is still pending,” she revealed.

She added that the NDIC has ramped up public awareness efforts and continues to engage with the judiciary as key stakeholders to support its deposit insurance mandate in line with international standards set by the International Association of Deposit Insurers (IADI).

In his own remarks, the Administrator of the National Judicial Institute, Hon. Justice Salisu Garba Abdullahi, reiterated the judiciary’s central role in ensuring stability in Nigeria’s banking system.

“The National Judicial Institute remains committed to facilitating continuous education and capacity enhancement for judicial officers. This ensures they are equipped to navigate complex financial regulations, interpret emerging legal frameworks, and adjudicate disputes with precision,” he stated.

Justice Abdullahi stressed that depositor confidence is the bedrock of the banking sector and that judicial decisions influence investor protection and the resilience of financial institutions.

He described the seminar as a platform to explore global best practices, refine legal interpretations, and identify strategic solutions to financial instability. He also addressed the rapid transformation of the banking sector, driven by digital banking, cryptocurrency, and DeFi.

“These developments require a judiciary that is forward-thinking and adaptable to new financial realities. Your Lordships and other distinguished participants must take full advantage of this engagement to share ideas and propose workable solutions,” he urged

Justice Abdullahi concluded by expressing appreciation to the CJN for approving the collaboration between the NJI and the NDIC.

He also thanked Justice John Inyang Okoro for his contributions in developing the seminar’s content, and recognised Hon. Justice John T. Tsoho, Chief Judge of the Federal High Court, for his ongoing support.

The three-day seminar continues with deliberations aimed at reinforcing the legal framework supporting Nigeria’s financial system and enhancing the capacity of judicial officers in financial adjudication.

-Advertisement-

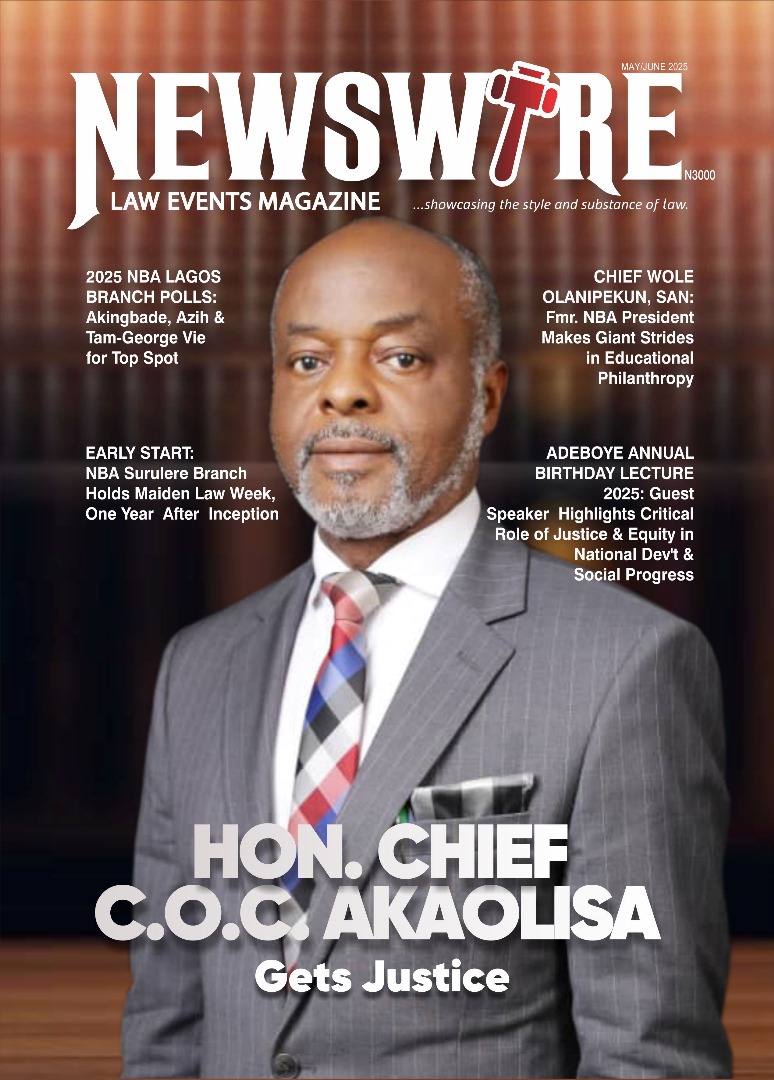

Grab our latest Magazine, "Hon. Chief C.O.C Akaolisa gets justice". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did