The Central Bank of Nigeria (CBN) has announced the revocation of operating licenses of two mortgage banks.

In a circular issued on Tuesday and signed by its Ag. Director, Corporate Communications Department, Hakama Ali, the apex Bank, noted that the move was part of its efforts to reposition the mortgage sub-sector and promote a culture of compliance with relevant laws and regulations.

It cited Section 12 of BOFIA 2020 and Section 7.3 of the Revised Guidelines for Mortgage Banks in Nigeria, which allows it to exercise its powers.

The affected banks are: Aso Savings and Loans Plc and Union Homes Savings and Loans Plc.

The CBN said, “The affected institutions had violated various Sections of BOFIA 2020 and the Revised Guidelines for Mortgage Banks in Nigeria, including: failure to meet the minimum paid-up share capital requirement for the category of the bank licence granted to them by the CBN, and having insufficient assets to meet their liabilities.

Other violated guidelines include being critically undercapitalised with a capital adequacy ratio below the prudential minimum ratio as prescribed by the CBN, and failure to comply with several directives and obligations imposed upon them by the CBN.

“The CBN remains committed to its core mandate of ensuring financial system stability”, the circular added.

-Advertisement-

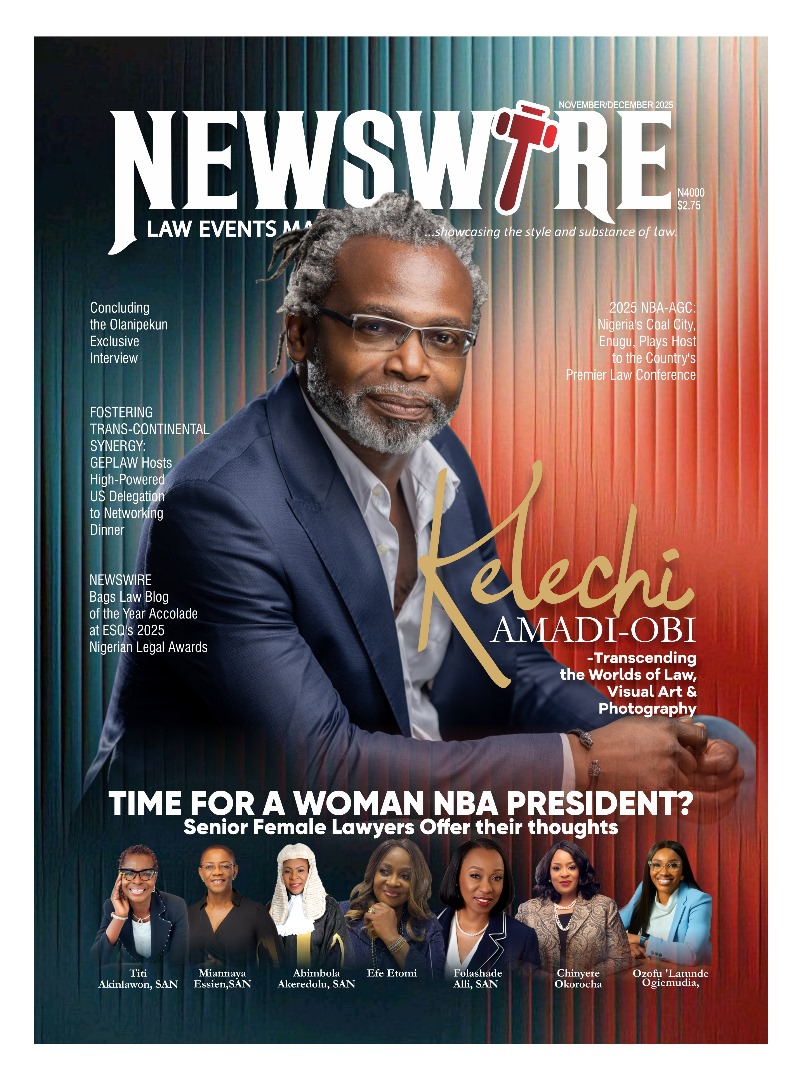

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk