The Central Bank of Nigeria (CBN), alongside law enforcement agencies, will closely monitor the Nigerian banking sector’s recapitalization efforts to prevent the influx of illicit financing into the sector.

A circular signed by Mr Haruna Mustafa, the Director of the Financial Policy and Regulation Department at the CBN, disclosed this.

The circular was addressed to commercial, merchant, and non-interest banks, including promoters of proposed banks, on the new minimum capital requirements for banks

The circular makes clear the CBN’s intention to apply its robust anti-money laundering regulations vigorously. With the collaboration of relevant law enforcement agencies, the bank aims to ensure that the capital raised during the recapitalisation process is free from the taint of illegality.

Banks are required to conduct comprehensive anti-money laundering screening checks. This includes Know Your Customer (KYC), Customer Due Diligence, and monitoring suspicious transactions to prevent the use of illicit funds in the recapitalisation exercise. . The circular read:

“The CBN has robust anti-money laundering regulations which will be strictly enforced, with the active collaboration of relevant law enforcement agencies.

“In addition, the CBN will require all banks to ensure that appropriate and effective anti-money laundering screening/checks (Know Your Customer, Customer Due Diligence and Suspicious Transactions Monitoring, etc) are conducted.”

Additionally, the circular addresses the vetting of new investors and significant shareholders. It emphasizes the need to ensure that only individuals and entities meeting the ‘Fit and Proper’ criteria are allowed to significantly invest in or own shares in banks.

This measure calls for the strict enforcement of background checks on all prospective significant shareholders, as well as directors and senior management staff, to uphold the sector’s leadership and ownership integrity.

The circular added:

“The CBN will actively monitor and supervise the recapitalization process to ensure compliance with set guidelines.

“This will involve the conduct of on- and off-site reviews, verification of capital, periodic interventions when necessary and broader stakeholder engagements.”

The CBN further identified the options available to banks for capital augmentation. These include the issuance of new common shares through public offers, rights issues, or private placements. Banks may also consider mergers and acquisitions or adjusting their license categories to comply with the new requirements.

The circular noted:

“Banks may meet the new requirement through the following options: a. Issuance of new common shares (by way of public offer, rights issues, or private placements); b. Mergers and Acquisitions (M&As); or c. upgrade/downgrade of their respective license category or authorization.

“The CBN will issue guidelines to prescribe the definition, options and approaches to meeting the new minimum capital requirement.”

The apex bank added that the paid-up capital and share premium will be the sole components considered for the new capital levels, explicitly excluding Additional Tier 1 (AT1) Capital.

-Advertisement-

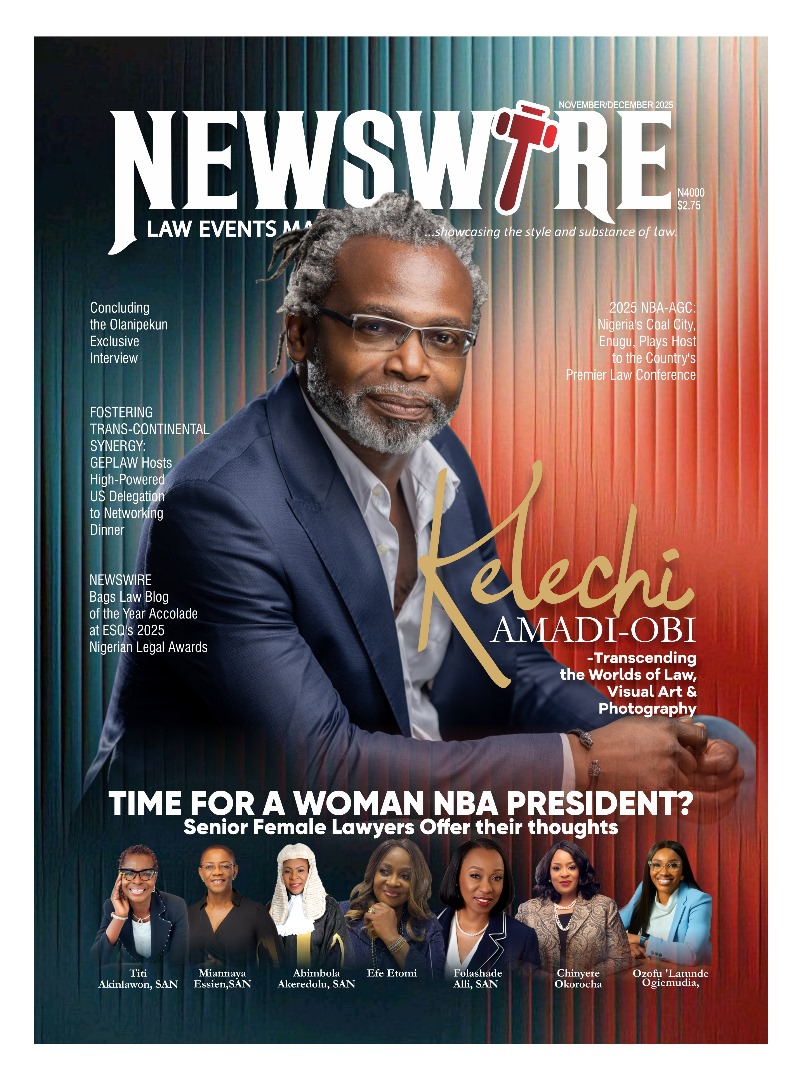

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk