The Nigeria Labour Congress has threatened to revolt against plans to commence the implementation of the newly enacted tax reform laws from January 1, 2026.

The NLC said it was not aware of the tax laws, as it was not carried along in their drafting, nor after they were passed and assented to by the National Assembly and President Bola Tinubu.

While raising concerns about the timing, lack of clarity and the likely impact of the implementation on workers and businesses, the NLC warned that the reforms would not only worsen the burden on citizens but also hurt small businesses and slow economic activity.

However, the Manufacturers Association of Nigeria declared support for the laws, saying they would be friendly and beneficial to its members.

This is even as small and medium-scale business operators and the Employers Association for Private Employment Agencies of Nigeria called for the suspension of the implementation of the laws, citing poor awareness and inadequate stakeholder engagement.

But the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, defended the laws, warning that delaying the reforms could push up the prices of basic goods and services, including food, healthcare and education, while keeping workers and small businesses overtaxed.

Oyedele warned that delaying the reforms would mean retaining the current tax regime, which he said placed a heavy burden on workers and small businesses.

The controversial tax regime became law on June 26 when President Bola Tinubu signed the four major tax reform bills into law, marking what the government has described as the most significant overhaul of Nigeria’s tax system in decades.

The laws include the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service (Establishment) Act and the Joint Revenue Board (Establishment) Act, all operating under a single authority, the Nigeria Revenue Service.

However, the laws came under intense scrutiny last week when a member of the House of Representatives, Abdussamad Dasuki (PDP, Sokoto), alleged discrepancies between the tax laws passed by the National Assembly and the versions gazetted and released to the public.

Dasuki, who made the allegations during plenary last Wednesday, insisted that the content of the gazetted tax laws did not reflect what members debated, voted on and passed.

-Advertisement-

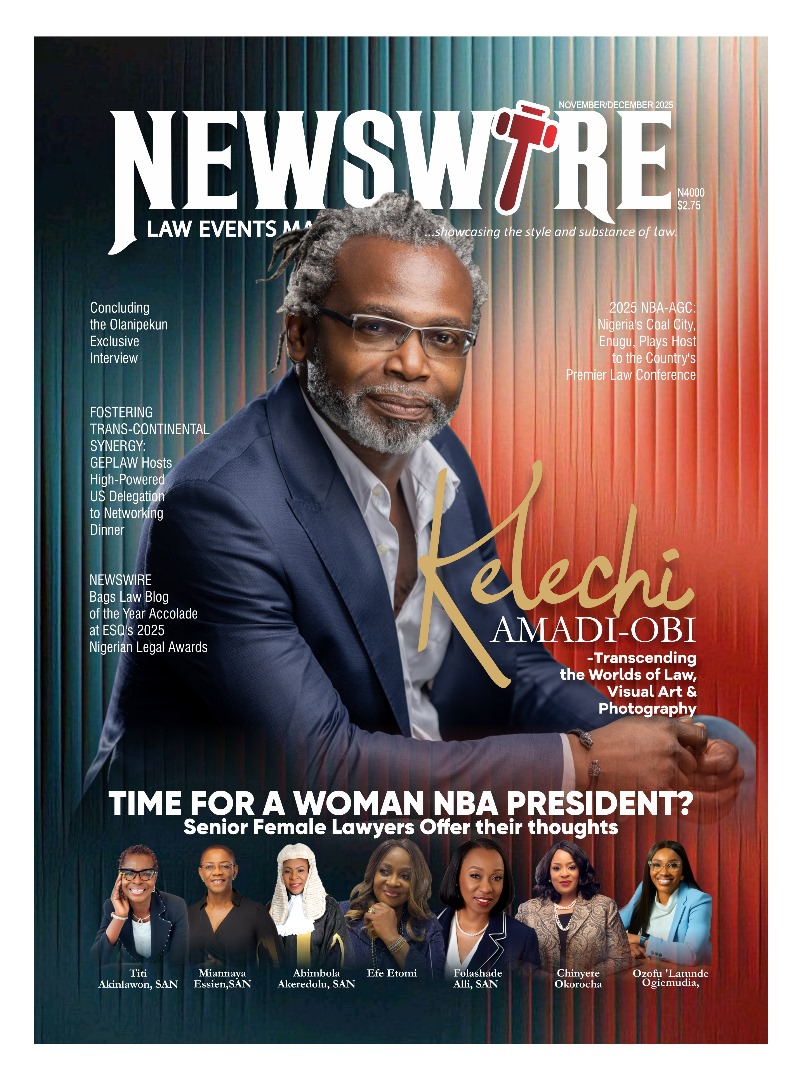

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk