Nigeria’s external reserves hit a six-year high, rising above $45 billion mark, in a historical move.

Latest data released by the Central Bank of Nigeria (CBN) showed that such a peak was last recorded on July 23, 2019, when they stood at $45.04 billion.

The external buffers now stand at $45.04 billion, after climbing to $42.03 billion on September 19, 2025.

This means the nation has added nearly $5 billion to its reserves within a short period.

The rise in the country’s external reserves is not a one-off spike but a steady, consistent accumulation that reflects improving foreign exchange conditions.

A breakdown showed that November began with reserves at $43.26 billion, maintaining a firm hold above the $43 billion threshold for several days.

By November 18, the reserves climbed to $44.05 billion, closing at $44.67 billion, one of the strongest month-end positions recorded in recent times.

The increase tiptoed into December, with the reserves starting the month still within the $44 billion range.

On December 4, Nigeria’s external reserves then crossed the $45 billion mark, indicating robust FX liquidity.

The steady buildup from $43 billion at the start of November to $45 billion by early December suggests improved inflows rather than temporary gains.

Last month, the CBN Governor, Olayemi Cardoso, said the reserves had hit $46.7bn as of November 14, 2025

Represented by the Deputy Governor in charge of Economic Policy, Dr Muhammad Abdullahi, speaking at the 20th Anniversary of the Monetary Policy Department, said the reserves had reached a new high level, the first time the country has attained such a level since 2018.

Cardoso said the reserves milestone reflected renewed investor confidence, improved oil receipts, and stronger balance-of-payments inflows.

“Foreign reserves have risen to $46.7bn as of November 14, 2025, providing 10.3 months of import cover in goods and services, supported by sustained inflows and renewed investor participation across various asset classes.

“This accretion reflects investor confidence in our policies leading to improved oil receipts, stronger balance of payments, and renewed foreign portfolio inflows,” Cardoso said.

He argued that the stronger reserve position was a key pillar behind the naira’s stabilisation, noting that the gap between the official and Bureau de Change windows had narrowed to below 2 per cent.

According to him, the currency’s recovery has encouraged foreign participation in Nigeria’s fixed-income and money markets, with investors responding to clearer policy signals and tighter monetary conditions.

Cardoso said the reforms driving foreign-currency inflows had also translated into sustained disinflation.

Headline inflation eased to 16.05 per cent in October 2025, from 34.6 per cent at its peak in November 2024.

He described the fall as “seven consecutive months of disinflation” and “the lowest in three years,” adding that core inflation was also beginning to soften.

-Advertisement-

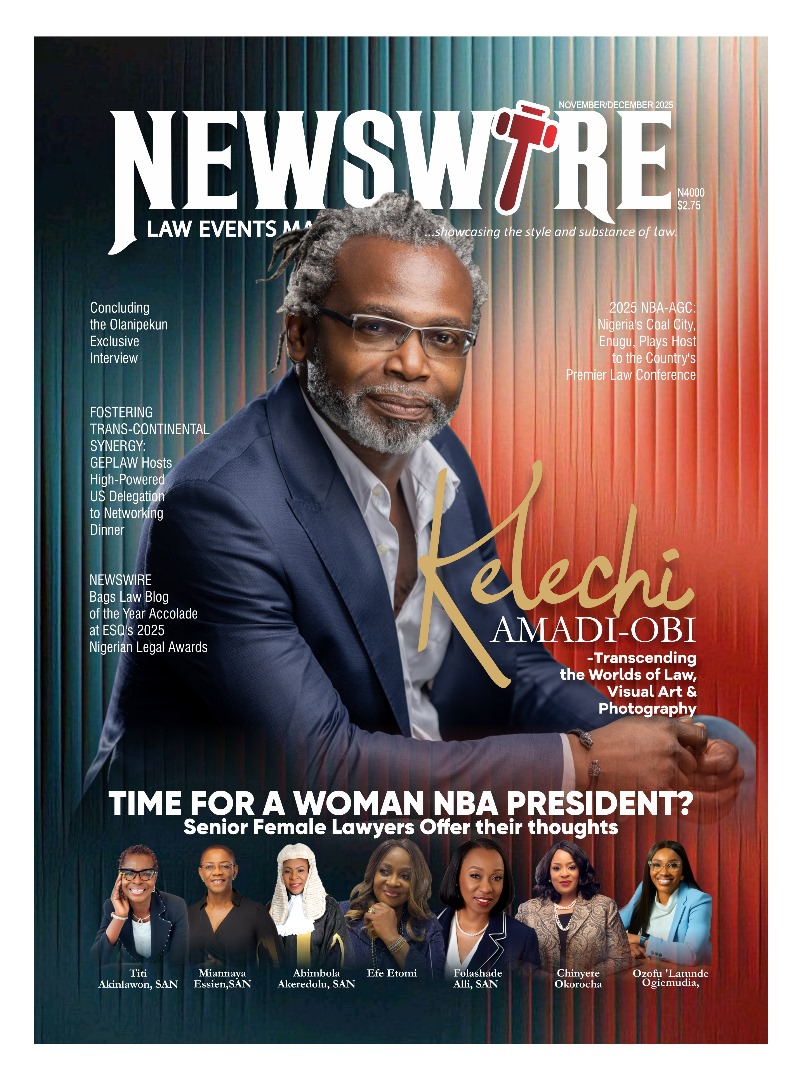

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk