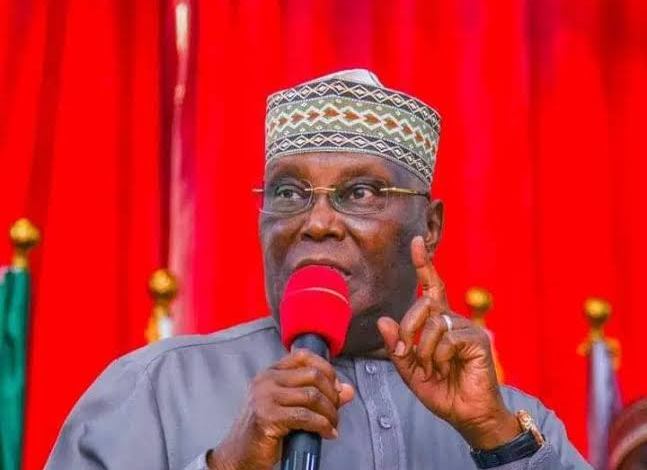

Former Vice President Atiku Abubakar has urged the Federal Government to immediately suspend the engagement of Xpress Payments Solutions Limited as the new Treasury Single Account collecting agent until the process leading to the firm’s appointment is subjected to public scrutiny.

In a statement shared on his verified X handle, #atiku, on Sunday, Atiku described the appointment as a “dangerous resurrection” of the Alpha Beta revenue cartel, which he said held sway during the administration of Bola Tinubu as governor of Lagos State.

According to him, the use of Alpha Beta as a revenue collector for Lagos State created a system that channelled public funds to private accounts at the expense of the people.

The statement read in part,” The quiet appointment of Xpress Payments Solutions Limited as a new TSA collecting agent is not an administrative decision, it is a dangerous resurrection of the Alpha Beta revenue cartel that dominated Lagos State during and after the Tinubu years.

“That model created a private toll gate around public revenue and funnelled state funds into the hands of a politically connected monopoly.

“What we are witnessing now is the attempt to nationalise that same template, moving Nigeria from a republic to a private holding company controlled by a small circle of vested interests.”

Atiku added that introducing such a policy amid worsening insecurity was insensitive,” To introduce such a policy in the middle of a national tragedy, while Nigerians are mourning loved ones lost to the deepening insecurity crisis, is not only insensitive, it is a deliberate act of governance by stealth.

“When a nation is grieving, leadership should show empathy and focus on securing lives, not on expanding private revenue pipelines.”

He also questioned the process that led to Xpress Payments’ engagement, noting that there was no legislative input.

“Why was this appointment rushed and smuggled into the public space without consultation, stakeholder engagement, or National Assembly oversight?

“What value does Xpress Payments add that existing TSA channels do not already provide? Who truly benefits from this? Nigeria or an entrenched political network?

“This is not reform. This is state capture masquerading as digital innovation,” he said.

Atiku called for greater transparency in government operations, stating, “Nigeria does not need more middlemen between citizens and their government revenue. What we need is greater transparency, stronger institutions, and a tax system free from political capture.”

He therefore demanded an “immediate suspension of the Xpress Payments appointment pending a public inquiry,” as well as “Full disclosure of the contractual terms, beneficiaries, fee structures, and selection criteria.

“A comprehensive audit of TSA operations to prevent the creeping privatisation of revenue collection.”

“A legal framework, not executive shortcuts, that prohibits the insertion of private proxies into core government revenue systems.

“A national security priority shift, recognising that a country under assault cannot afford economic governance conducted in the shadows.”

The former Vice President concluded that “Nigeria’s revenues are not political spoils. They are the lifeblood of our national survival, especially at a time when insecurity is tearing communities apart.

“The government must abandon this Lagos-style revenue cartelisation and return to the path of transparency, constitutionalism, and public accountability.”

The Treasury Single Account is a public finance reform initiative designed to consolidate government revenues into a unified account to promote transparency and curb leakages.

Although first recommended by the World Bank for Nigeria in 2004, the policy was not implemented at the federal level until the Goodluck Jonathan administration directed all Ministries, Departments and Agencies to begin partial compliance in 2012.

Full implementation commenced in 2015 after President Muhammadu Buhari ordered all federal revenue-generating bodies to remit earnings into the TSA domiciled at the Central Bank of Nigeria.

Before the reform, MDAs maintained thousands of bank accounts in commercial banks, a system that enabled diversion of public funds, delayed remittances, and made effective oversight difficult.

The TSA was introduced to address these gaps by ensuring real-time monitoring of government inflows, reducing borrowing costs, and improving overall fiscal discipline.

Since its rollout, the system has been credited with tightening controls around federal revenue, though debates persist over the role of private firms in its operation and the transparency of associated procurement processes.

-Advertisement-

Grab our latest Magazine, "Chief Wole Olanipekun, CFR, SAN, A man of wide horizons and deep intentions". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk