Sterling Bank grows Profit After Tax by 65% to N8.521bn

Sterling Bank Plc on Monday reported a growth of 65 per cent in profit after tax (PAT) for the year ended December 31, 2018. The audited results of the bank showed PAT of N8.521 billion, up from N5.163 billion posted in the 2016. The profit was recorded from gross earnings of N133.490 billion in 2017, compared with N111.440 billion in 2016.

The financial institution ended the year with net interest income of N50.180 billion, down from N55.990 billion, while impairment charges rose from N11.714 billion to N12.267 billion in 2017. Profit before tax grew from N6 billion to N8.606 billion, while PAT improved from N5.163 billion to N8.521 billion.

Based on the results, the board of directors of the bank has recommended a dividend of two kobo per share for the shareholders’ approval.

The former Managing Director/Chief Executive of Sterling Bank Plc, Mr. Yemi Adeola, had last year told shareholders that bank would aggressively grow its retail business through electronic channels over the next five years.

According to him, the bank would continue to boost innovative banking, driven by market insights that would enable it serve its customers satisfactorily, implement significant investment in technology-led growth initiatives and accelerate the growth of its non-interest banking segment.

Meanwhile, the JSE Securities Exchange has lifted the technical suspension on Oando Plc. According to the South African bourse, it acted based on information from the Nigerian Stock Exchange (NSE), which is the primary listing of the Oando Plc.

The NSE had last Wednesday lifted the technical suspension on the shares of the energy and gas company before reinstating the suspension some hours later.

The Exchange said subsequent to the lifting of the technical suspension, on 11 April 2018, it received another communication from SEC to maintain the status quo prior to the Commission’s letter of 9 April 2018, (the technical suspension of trading in Oando’s shares.)

“In the overall interest of investors in Nigeria’s capital markets, and following consultation with the Commission please be advised that at the start of trading tomorrow (today), 12 April 2018, trading in Oando’s shares will resume without any impediment in price movement consistent with the NSE’s market structure.”

In its own explanation, SEC said the technical suspension of Oando shares took longer than expected on account of the lawsuits from its shareholders and the company itself.

“However, the suspension of the shares of Oando Plc was prolonged due to several litigations by Oando and other shareholders contesting the propriety of the forensic audit and technical suspension. All litigations have now been withdrawn, the independent forensic audit by Deloitte is ongoing and the preliminary result is expected,” the capital market regulator said.

Do you need to be heard? Or your articles published? Send your views, messages, articles or press release to: newswiremagazine@yahoo.co.uk >>> We can cover your (LAW) events at the first Call: 08039218044, 08024004726

-Advertisement-

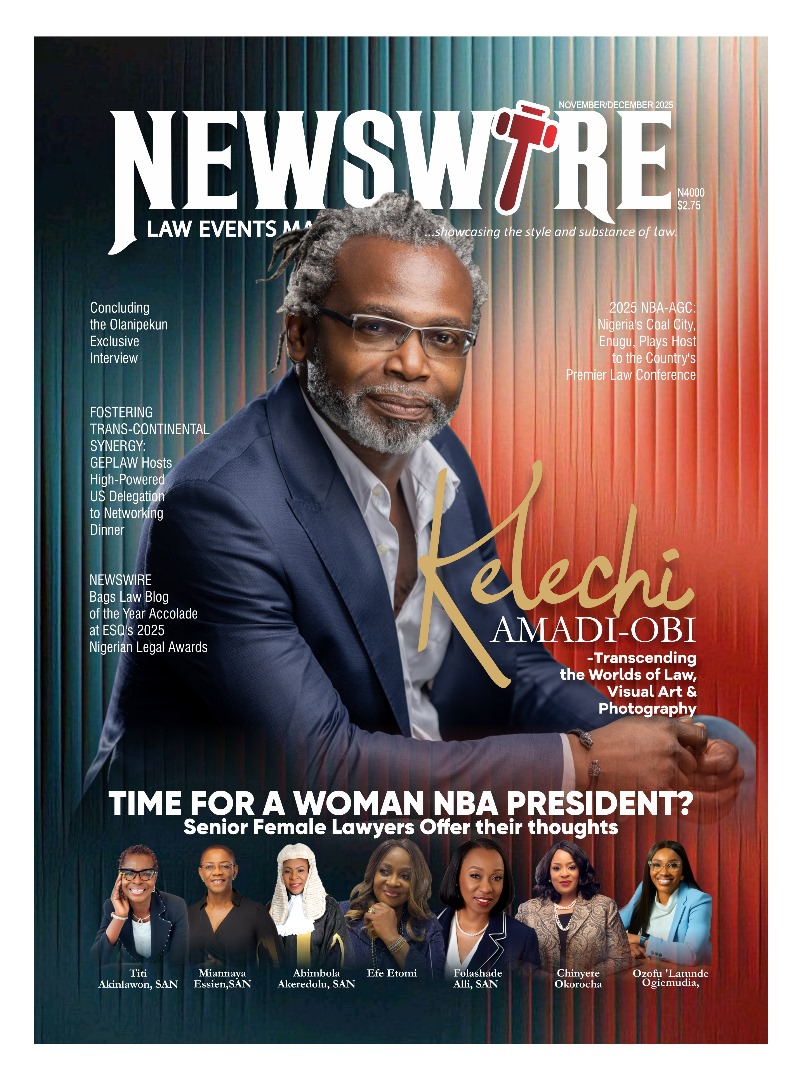

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk