Reflections on The Banks and Other Financial Institutions Act, 2020 – By Rose Adaji and Benard Esan, Both of Alliance Law Firm

1. Introduction

Since the enactment of the Banks and Other Financial Institutions Act (BOFIA) 2020, (“BOFIA 2020” or the “Act”) it has, predictably, attracted wide-ranging reactions from commentators and stakeholders. The expectations of many are that, given the several challenges that the financial services sector in Nigeria has witnessed over time, some of which include weak risk assets, high ratio of non-performing loans, poor corporate governance practices, double-digit interest rates and perceived over-regularisation of the sector, every policy intervention would be geared towards prioritising resolution of these issues while enhancing the ease of doing business environment.

This article seeks to interrogate some of the changes introduced in the new Act and to consider the potential impact that they could portend for the industry. The question arises whether the modifications made to the previous legislation being repealed address the critical challenges confronting the industry or whether they operate to compound them. Whichever side of the divide you pitch your tent with, the impact of this new piece of legislation is bound to reverberate within and beyond the industry for some time to come.

2. Reviewing some of the critical changes introduced

A school of thought strongly contend that BOFIA 2020 is a game changer, especially when viewed against the backdrop of the need to strengthen the legal framework for regulating banks in order to avert the incidence of distress as experienced in 2009 when an estimated loss in excess of N5 Trillion hit the sector in addition to the erosion of shareholders’ funds, value and reputation. We now consider some of the more critical changes introduced and their potential impact on the financial services sector.

2.1 Enhanced regime of sanctions for specified infractions

This section deals generally with the powers of the CBN to revoke or vary the conditions imposed for the grant of a banking license and then proceeds to impose in subsection 6 thereof sanctions on any director, manager or officer of a bank who fails to take reasonable steps to ensure compliance with any of the conditions of the licence. In other words, such non-compliance has been criminalised and is punishable on conviction by a term of not less than 3 years imprisonment or a fine of not less than N2,000,000.00 or both.1

1 Section 5(6) of BOFIA 2020

The jury is out on the desirability of criminalising failure of an investor to meet certain conditions of the license when what could well happen is to deny such licensee the privileges and rights attached thereto unless and until complied with.

2.3 Enlarged powers of the CBN

The Act enhances the powers of the CBN in some respects. For example, it gives the Governor of the apex bank extensive powers of approval over matters including change in the control of a bank or the control of significant shareholding in a bank; sale, transfer or disposal of the whole or any part of a bank; mergers and acquisition involving banks; reconstruction, reorganisation or restructuring of a bank. Failure to comply has been criminalised and is punishable with a fine of no less than N20,000,000.00.2

2 Section 7 of BOFIA 2020

3 Section 3(d) of BOFIA 2020

4 Section 3 (5) and (6) of BOFIA 2020

In its bid to sanitise the industry, the hand of the apex regulator may need to be strengthened in this regard in order to avoid anti-competitive and other abusive practices that may imperil system stability. However, concerns have been expressed about the seeming over regulation of the industry and whittling down of the powers of the Federal Competition and Consumer Protection Commission (FCCPC) in the area of monitoring anti-trust practices. The questions arise as to how the potential conflicts of roles and functions of the CBN vis-à-vis the FCCPC would be adequately resolved without inviting the courts to interprete same.

2.4 Recognition of non-interest banking

The Act has formally acknowledged non-interest banking in Nigeria and set out the procedure for obtaining the grant of a license for non-interest banking in Nigeria. Such applicant Bank is required, amongst other conditions, to submit a list of experts on non-interest banking to act as its advisory committee. This seems to be a response to the yearnings for alternative modes of financing in the light of the increased cost of obtaining credit facilities for business operations such as Islamic and other non-interest credit facilities.3 This has been well received and it is expected to deepen the market for sources of business finance and stimulate greater economic activity within the economy.

2.5 Outright ban on unregistered foreign banks

The Act outrightly prohibits unregistered or unregulated foreign banks from operating in Nigeria. No Nigerian Bank is to establish or continue such banking relationship with such banks as failure to adhere to this requirement attracts a penalty of not less than N20,000,000 and an additional penalty of N500,000 for each day the infraction continues.4 This is a welcome development in the industry and would help tackle capital flight, transfer pricing abuses and tax evasion.

2.6 Additional grounds for revocation of banking licence

The Act has introduced additional grounds upon which a banking license may be revoked. These include where a bank:

- i. conducts its business in an unsound manner or its directors engage in unsafe practices; or

- ii. is involved in a situation, circumstance, action or inaction which constitutes a threat to financial stability; or

- iii. in the opinion of the CBN a bank is critically undercapitalised with a capital adequacy ratio below the prudential minimum or such other ratio as the bank may prescribe;

- iv. fails to commence banking operations within a period of twelve months following the grant of a licence; or

- v. fails to comply with the minimum paid up share capital requirement fixed in section 9 or minimum capital ratio as set by the Bank.

5 Section 12 of BOFIA 2020

6 Section 17(1)(d) of BOFIA 2020

Genuine concerns have been raised about the unfeterred latitude that the CBN now has to determine what constitutes “unsound” and “unsafe” conduct or business practices or acts which are “a threat to financial stability”. There is no definition in the Act for what these infractions comprise of or what the elements of these violations are in order to provide guidance to all stakeholders in the industry. It does leave ample room for abuse by regulators who may, unsuspectingly, open themselves to political influences and extraneous considerations for enforcing the intendments of the drafters.

2.8 Restriction on payment of dividends

The Act suspends payment of dividend on shares by banks until satisfaction of any corporate governance and prudential requirements stipulated by the Bank.6 This is, in our view, an excellent addition to the law and would help engender a culture of sound corporate governance practices and prudential discipline. It would also help ensure that banks focus more on growing shareholder value and providing for the interests of other stakeholders in an enlightened manner. Ultimately, if banks observe healthy corporate behaviour, they would be better managed, returns on investments would improve, profitability would be enhanced and they would be better positioned to facilitate economic, social and environmental goals of the environments in which they operate. However, concerns remain regarding the role of CBN Examiners as observers of management and board meetings which could stifle expressiveness and compromise independence of thought and action that board directors need to be able to exercise as purveyors of strategic growth for their organisations.

2.9 Personal liability of all directors

The Act imposes personal liability on all directors of a bank, jointly and severally, to indemnify the bank against losses arising from any advances, loans or credit facilities granted in contravention of section 19 of the Act.7 This would help promote accountability and a high sense of responsibility in the management of depositors’ funds within the industry as the risks attached to errant behaviour or impunity act as a deterrent.

7 Section 19(7) of BOFIA 2020.

8 Sections 29, 57, 60 and 69 of BOFIA 2020

9 Section 12(1) (a-j) of BOFIA 2020

10 Section 12(4) & (5) of BOFIA 2020

11 Section 12(6) of BOFIA2020

2.10 Supervision of Fintechs

CBN is empowered to supervise banks, other financial institutions and specialised banks which include Microfinance Banks, Financial technology companies (Fintechs), Agricultural bank, bank of industry, development banks, Nigerian Export Import Bank etc. 8 This has put to rest arguments in some quarters that financial technology companies ought not to be regulated by CBN giving that they do not receive deposits and advance loans like traditional banks do.

While arguments regarding the level of regulation that should be imposed on Fintechs continue to rage, the point needs to be made that, for as long Fintechs solicit for and keep custody of monies belonging to members of the public in the same manner as deposit money institutions do, some level of regulatory intervention is welcome. This would introduce a level of prudential behaviour and sanity within the industry as participants know that where they fall below certain thresholds of minimum conduct, sanctions could be imposed to whip them into line and regulate sound financial practices.

2.11 Ousting the powers of the courts

The Act states that the CBN is empowered to revoke the license of any institution to which it refers on grounds stated therein.9 It then proceeds to stipulate the periods within which any challenge of that decision must be initiated, the forum of challenge and the speed with which such matters shall be heard and determined.10 Significantly, it affirms that no court in the land shall have the authority to grant any restorative relief in relation to the revoked licence and that reliefs, if any, may only be by way of monetary compensation not exceeding the value of the paid-up capital of the bank at the time of the revocation of the license.11

These provisions, without a shadow of the doubt, circumscribe the powers of courts created and empowered by the constitution. To the extent that it arrogates to itself the powers to chop and change authority given to these courts by the constitution of the Federal Republic of Nigeria, 1999, there are strong grounds for securing an order of nullity and voidness from the judiciary. In the case of AG Abia State & Ors V. AG Federation,12 per KALGO J.S.C.

12 (2002) LPELR-611(SC); Pp. 195-196, paras, F-B

13 Section 45

14 Section 65

“The Constitution is what is called the grundnorm and the fundamental law of the land. All other legislations in the land take their hierarchy from the provisions of the Constitution. By the provisions of the Constitution, the laws made by the National Assembly comes next to the Constitution; followed by those made by the House of Assembly of a State. By virtue of Section 1(1) of the Constitution, the provisions of the Constitution take precedence over any law enacted by the National Assembly even though the National Assembly has the power to amend the Constitution itself.”

We are of the view that this could erode investors’ confidence in the sector if players with the deep pockets looking to reap returns from this space are limited in the nature remedies they may be able to procure from courts in the land.

2.12 Response to pandemic

The Act seeks to suspend the liability of banks to their customers in the event of closure or failure to open for business during strikes, epidemics or pandemics.13 Clearly, this is a welcome development as it takes into account the current realities of our times in which businesses have been constrained to operate remotely in response to Covid-19 pandemic. It is an acknowledgement of the imperative that force majeure events or Acts of God may occur over the course of contract performance and that inability to carry out contractual obligations may be down to circumstances beyond the control of the parties. This addition to the Act provides protection for the banks with respect to the liabilities that would otherwise occur in the ordinary course of their contracts.

2.13 Federal Competition and Consumer Protection Act no longer applicable

The Act ousts the application of the Federal Competition and Consumer Protection Act (“FCCPA”) to banks save for sections 92 (1), (2) and (3), section 94 and 98 thereof which are to apply to mergers, acquisitions and other forms of business combinations involving a bank.14 The CBN Governor is, however, empowered to prescribe additional rules for mergers, acquisitions, other business combinations involving banks, specialised banks and other financial institutions.

2.14 Establishment of a Banking Sector Resolution Fund

This Fund is to be domiciled with the CBN and shall warehouse all contributions and levies imposed under BOFIA. The CBN is to contribute 10 Billion Naira or such amount as its Board may from time to time determine to this fund while an annual levy in an amount equivalent to ten (10) basis points (or as may be determined by the CBN) of its total assets as at the date of its audited financial statements. The NDIC is

to pay N4,000,000,000 into the Fund while banks shall pay10 points of its total assets. The Fund is to be utilized for the costs of reviving an ailing bank, which includes the costs of a bridge bank, provision of loan, overdraft or other credit facility to such bank, etc.15

15 Sections 74 to 78

16 Section 97 of BOFIA

17 Sections 102, 115, 123 and 127

2.15 Power to freeze accounts

The CBN is empowered to apply by means of an ex-parte application to the Federal High Court for the freezing of accounts with any bank or other financial institution if the Governor has reason to believe that transactions undertaken in such account involve the commission of any criminal offence.16 We are unsure about the value of this section as there are sufficient provisions in existing laws and under the Constitution of the Federal Republic of Nigeria which empower government agencies and institutions, including the CBN, to approach the courts for any remedy designed to truncate the activities of unscrupulous members of our society.

2.16 Establishment of a special tribunal

The Act also established the Special Tribunal for the Enforcement and Recovery of Eligible Loans (the Tribunal). The composition of the Tribunal is eleven (11) full time members appointed by the President of Nigeria while the quorum is a member of the panel sitting alone. The jurisdiction of the Tribunal covers enforcement and recovery of eligible loans by banks and other financial institutions, enforcement of security or guarantee attachment of any assets under an eligible loan given by any bank, etc. The Tribunal has concurrent jurisdiction with the various High Courts on these matters. The Tribunal may also be assisted by a panel of experts who shall assist the Tribunal as may be required. Qualification for membership of the panel is a minimum of twelve (12) years post-call experience and five (5) years’ experience in banking and financial services industry, law and practice or in banking and financial services sector. Appeals lie from the decisions of the Tribunal to the Court of Appeal.17

This move would appear to be one borne out of frustrations with the unduly protracted nature of trials before traditional courts created under the Constitution of the Federal Republic of Nigeria. Thus, in a bid to fast track the hearings of cases relating to debt recovery and enforcement of resulting judgments, this special purpose vehicle has been birthed with a view to helping financial services institutions quickly recover their non-performing risk assets. While the motivation behind this initiative is well grounded, the question arises as to how it would fit into the current legal framework in the Federal High Court and the continuing relevance of AMCON in the recovery of bank eligible loans.

This article was authored by Rose Adaji (Senior Associate) and Benard Esan (Associate), both of Alliance Law Firm.

Do you want to be heard, your events covered, your articles published, or needs to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 08059676999, 09070309355. Email: newswiremagazine@yahoo.co.uk

-Advertisement-

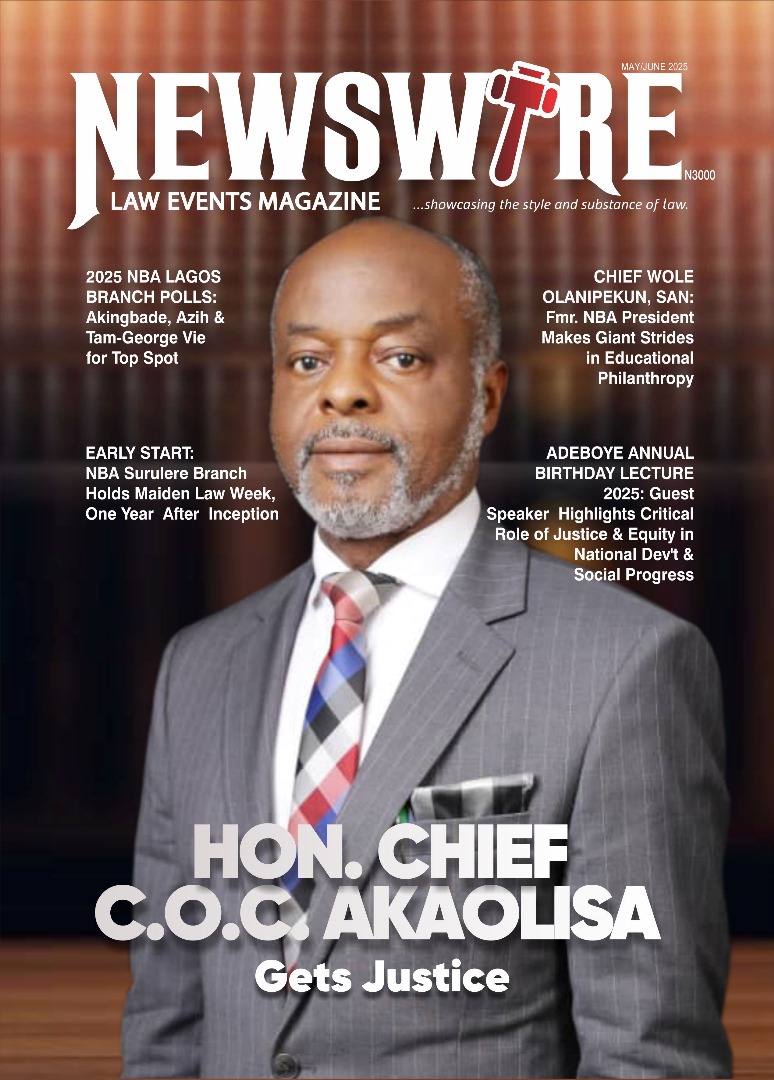

Grab our latest Magazine, "Hon. Chief C.O.C Akaolisa gets justice". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did