Dear Honoured Guests,

Owing to logistical reasons and to ensure your comfort, DSC Publications have found it necessary to change the VENUE of the DEJI SASEGBON SAN Memorial Book Launch of SASEGBON’S JUDICIAL DICTIONARY OF NIGERIAN LAW.

The date and time remain the same: Thursday 14/11/19 at 1pm.

The VENUE IS NOW AGIP HALL, MUSON CENTRE, ONIKAN, LAGOS.

We look forward to your presence at the event to honour Deji Sasegbon’s memory and work. God bless you.

Mrs. Oge Sasegbon

Nigeria to Lure Foreign Investors with Attractive Tax Incentives

Foreign investors looking to invest have been advised to choose Nigeria as their first option for business considering the attractive tax incentives, reliefs and attractive end-price the country offers. This plea was made by Babatunde Fowler, Executive Chairman of the Federal Inland Revenue Service (FIRS) during the Nigeria-Canada Investment Summit in Abuja.

According to Fowler, the attractive tax incentives include:

- Reliefs in Personal Income Tax Act (PITA);

- Companies Income Tax Act;

- Capital Gains Tax Act; and

- Value Added Tax Act.

Added to these, non-oil sector performance is expected to grow in the next three years, making up about 80% of government revenue.

Fowler noted that non-oil sector contribution to the Nigerian economy had risen to 60% currently, from 54% in December 2018, noting that the continuous drop in oil prices was a sign that attention should be focused on the non-oil sector that is more sustainable. In this, he referred to agriculture as a key component in his expectation.

Fowler said that the use of technology (through online payment systems) had made tax administration more efficient, transparent and convenient leading to the generation of N25.6 billion from 2017 to date, adding that, “Integrated Tax Administration System (ITAS) project is a suite of programmes that enable the automation of FIRS tax processes.”

As part of the Service’s objectives to bring high-level efficiency to tax revenue collection and provide first-class services to taxpayers, ITAS project introduced SIGTAS, a solution that covers all aspects of tax administration in one integrated system.

In October, Fowler, in a news conference in Abuja disclosed that Nigeria loses about $15 billion to tax evasion annually through offshore tax evasion, though this figure may be grossly under reported as some economists believe that the figures may be higher.

The chairman disclosed that Nigeria would implement the first Automatic Exchange of Information Standard by 2020, as part of the commitment to improving transparency in tax administration, increased tax revenue collection, enhanced effectiveness, and efficient service delivery.

Deji Sasegbon’s Latest Dictionary: Place your order now. Call:08076095047, 07036688678, 08035629991

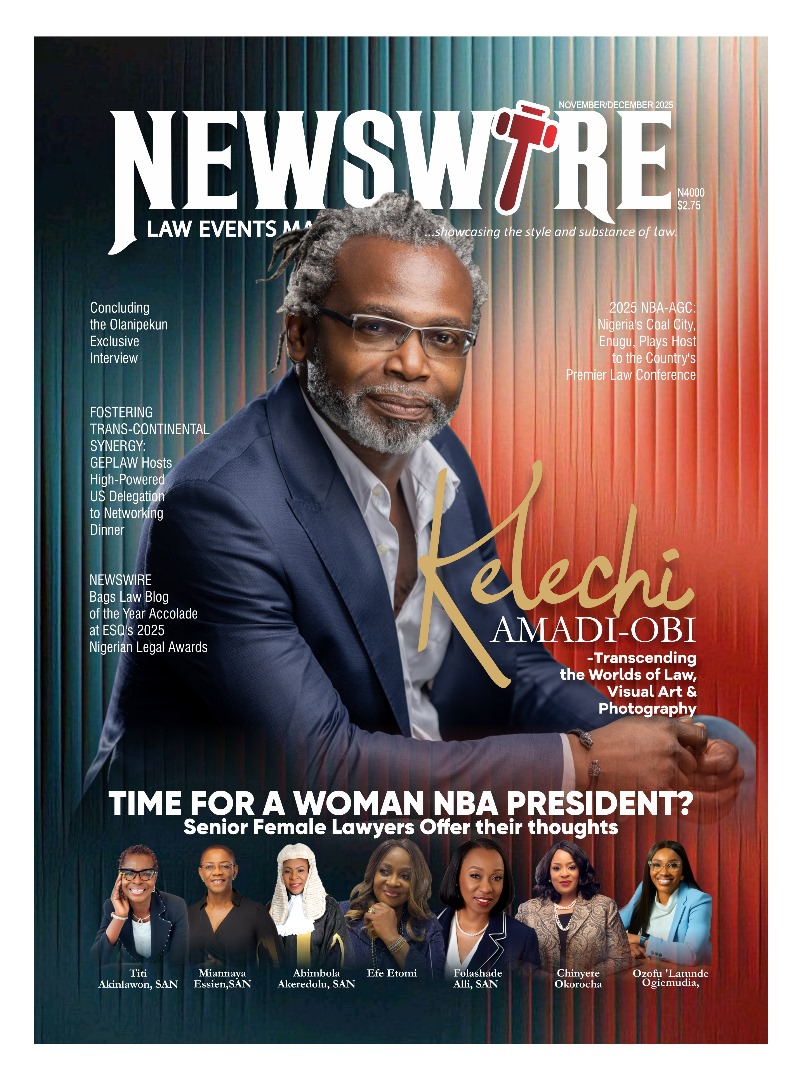

Newswire, we present the world of law and the issues that engage them. This edition is yet again, ‘Mind-blowing’. Go get your copy(ies) Now!

Do you need to be heard? Or your articles published? Send your views, messages, articles or press release to: newswiremagazine@yahoo.co.uk >>> We can cover your (LAW) events at the first Call: 08039218044, 08024004726

-Advertisement-

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk