EFCC VS Innocent Chukwuma (INNOSON) – The True Position of Guaranty Trust Bank

In recent weeks, the media (both mainstream and social network) has been awash with the fallout of the arrest of the Founder and Chief Executive Officer of Innoson Motors, Dr. Innocent Chukwuma. As with most things Nigerian, the matter has since taken on a life of its own on account of its perceived sensitivity – with reactions ranging from the purely legalistic to the extra-legal, as various interested (and even disinterested) parties – including individuals and groups – have weighed in on the matter on various media platforms (including social media) in a bid to present their disparate positions on the matter, and, in some cases, even to influence its eventual outcome.

Through the fog of differing opinions and positions, however, some facts are clear, and they are as follows: a

The industrialist, popularly known by his company’s name, Innoson, was arrested by operatives of the Economic and Financial Crimes Commission (EFCC) at about 11 a.m. at his Savage Crescent, GRA, Enugu residence on Tuesday, December 19, 2017. His arrest, according to the EFCC, followed his refusal to honor an invitation by the commission having earlier jumped an administrative bail granted to him in a case being investigated by the Capital Market and Insurance Fraud Unit of the commission’s Lagos office.

The police subsequently filed Charge No. FHC/L/565C/2015 against Dr. Innocent Chukwuma and others for fraudulent clearance of goods, forgery, conversion, stealing and conspiracy, in a case presently pending at the Federal High Court, Ikoyi. Dr. Chukwuma was arrested and interrogated by operatives of the EFCC, following which he agreed to make monthly payments into Innoson’s account, domiciled in one of the country’s foremost banks, Guaranty Trust Bank (GTB) until the full liquidation of Innoson’s indebtedness to the bank. Following his default in making the agreed payments, investigations by the Nigeria Police found Innoson and Dr. Chukwuma culpable of the criminal allegations levied against them by the bank, and Dr. Chukwuma was accordingly charged to court by the Police.

The police investigations alleged that Innoson and Dr. Chukwuma deliberately set out to defraud, steal from the bank and convert the imported goods belonging to the bank by deceptive means and through forgery and misrepresentation. The unlawful takeover of the imported goods, which served as the bank’s collateral, left an indebtedness in excess of the sum of N1,654,481,895.04 (one billion, six hundred and fifty four million, four hundred and eighty one thousand, eight hundred and ninety five Naira, four Kobo) as at September 26, 2012.

The roots of the crisis go as far back as 2009, when GTB granted Dr. Chukwuma, on behalf of Innoson, several credit facilities to the tune of N2,400,000,000,00 (two billion, four hundred million Naira only), to part finance working capital requirements, import new motorcycles and motorcycle spare parts, agricultural spare parts and plastic manufacturing equipment. Under the loan terms agreed by Dr. Chukwuma, on behalf of Innoson, proprietary interest in the imported goods was consigned exclusively in favour of the bank. This means that the bank was the exclusive owner of said goods. Accordingly, the original shipping documents (i.e. the bills of lading) were in the custody of the bank, and have remained so at all times. In view of the bank’s status as exclusive owner of the imported goods, ownership of the goods could only be transferred to Innoson (or any third party) by the bank. The condition in the agreement between the bank and Innoson, for the release of said goods by the bank to Innoson, was payment by Innoson of 25% of the value of each letter of credit transaction.

In a bizarre twist, however, Chukwuma, on behalf of Innoson, approached the bank shortly after, with a request for the release of the shipping documents (even without payment of the agreed 25% equity). The bank duly declined his request on those grounds. But then, in June of 2011, it came to the bank’s knowledge that the imported goods for which the Bank had already declined to release shipping documents to Innoson, had been fraudulently procured by Innoson. The bank discovered that Dr. Chukwuma’s company, Innoson, had forged the bank’s endorsement on the bills of lading to the shipping line holding the goods, and fraudulently cleared them in the name of the bank, whereas the said goods, being the property of the bank should not have been cleared from the port without the original shipping documents being endorsed by the bank in favour of Innoson, or any third party so designated. The forged shipping documents used by Innoson to fraudulently clear goods at the port, as well as the bank’s stamp, bore the signatures of 4 (four) staff of the GTB, namely, Taofeek Olalere, Dan Attah, Bunmi Adeyemi and Amazu Amalachukwu. The Bank did not at any time endorse or transfer the shipping documents to Innoson, as the originals of each of the relevant bill of lading remain in the bank’s custody to this very day.

Following a report by GTB made to the police on the matter, the Innoson boss claimed that the bank had duly released the shipping documents to him. Consequently, the Police commenced investigation into the bank’s complaint, including a forensic examination of the disputed signatures, and established that the signatures of the above-named bank staff were forged, and the imported goods were fraudulently cleared from the Nigerian Ports Authority (NPA) by Dr. Chukwuma and his accomplices.

Innoson approached the Bank for a reconciliation of his account and pleaded for debt forgiveness, following which a reconciliation was carried out on the account – which had a debit balance of N1,654,481,895.04 as at December 31, 2011. In the spirit of amicable resolution, coupled with EFCC’s intervention, the bank agreed to forego the sum of N559,374,072.09 representing default charges accruing on the account and debited in line with the loan agreement between the customer and the bank. Based on this, the Bank decided to accept the sum of N1,095,107,822.95 from Innoson as full and final payment of his indebtedness to the bank – provided the agreed amount shall be fully paid not later than (30) days from the date of the letter written to him.

In another twist, however, apparently to further stall the criminal proceedings against him in a bid to stall the bank’s recovery steps and distract it from focusing on the criminal action, as well as civil actions filed for recovery of the debt, Innoson has since then commenced a series of legal actions, beginning with a suit (No. FHC/AWK/CS/2012) against the Bank at the Federal High Court, Awka and another suit the Federal High Court, Abuja against The Inspector-General of Police, The Nigeria Police Force and its Investigating Officer(s), seeking declaratory and injunctive reliefs, including orders restraining the Police from commencing criminal proceedings against Innoson. In these suits, he claimed that the bank had debited Innoson’s account with excess charges totalling N559, 374,072.09. To this end, he obtained judgement in excess of N4.7Billion against the Bank, in disregard of an agreement that was amicable reached between him and the Bank for a full and final settlement of N1,095,107,822.95 out of which the Bank graciously forwent the sum of N559,374,072.09 accruing on his account during the period under review.

In instituting various suits in various courts against various defendants, Dr. Chukwuma and Innoson have claimed outrageous sums of money against Guaranty Trust Bank.

In the face of the current drama between Dr. Chukwuma – and by extension, his company, Innoson Motors, Guaranty Trust Bank has maintained a stoic silence. Why, one may ask?

Well, first of all, the obvious truth is that Dr. Innocent Chukwuma is, and remains, a respected and valued customer of GTB, and as such entitled to a guarantee of confidentiality occasioned by such a relationship. Secondly, the matter between the bank and this particular customer (i.e. pertaining to the aforementioned forgery of shipping documents enabling him to fraudulently clear imported goods from the port in contravention of a mutual agreement) is sub judice (pending in a court of law), and therefore commenting on it could be perceived as a bid on the part of GTB to influence its outcome playing to the gallery.

In view of the dimensions this story has taken in recent weeks, however, (especially the current media frenzy surrounding it, and the issues it has thrown up, some of them totally extraneous to the facts of the controversy) the management of GTB is compelled to make a number of categorical clarifications and responses, by way of press releases and media briefings, as follows:

- GTB is NOT behind Innocent Chukwuma’s arrest by the Economic and Financial Crimes Commission. The bank has NO ROLE whatsoever, and is NOT A PARTY, to the EFCC’s charge to the effect that the industrialist committed a N1.4bn fraud and usage of forged documents to secure tax waivers. The case between GTB and Innoson, as stated above, and nothing more. And as already mentioned, the matter is sub judice and does not merit a media showdown.

- It is NOT TRUE that the GTB is part of a wider witch-hunt, spearheaded by the EFCC, of a prosperous and influential businessman from the South-Eastern geo-political zone of the country in pursuit of some spurious agenda by the government of the day to cripple his business and whittle his influence – as alleged in the media by a number of conspiracy theorists and ethnic defenders. To this absurd allegation, GTB’s response is simple: Dr. Innocent Chukwuma did not suddenly become an Igbo man at the beginning of his travails with the EFCC. He was still an Igbo man when he sought – and received – credit facilities from GTB in 2009. His dispute with GTB is purely legal, and nothing more.

- GTB takes NO pleasure, nor does it derive any benefit, from Dr. Chukwuma’s current travail and its potentially negative impact on his company Innoson Motors. On the contrary, the bank recognises the role of Innoson as a major player in Nigeria’s automotive industry and its economy in general, as well as its role in Nigeria’s industrial revolution and its status as a key employer of labour in a country plagued with high unemployment. It is the view of the bank, therefore, that, like GTB itself, Innoson is too big and too valuable a national asset to fail. GTB would, therefore, play NO part in such a terrible eventuality.

Do you need to be heard? Or your articles published? Send your views, messages, articles or press release to: newswiremagazine@yahoo.co.uk >>> We can cover your (LAW) events at the first Call: 08039218044, 08024004726

-Advertisement-

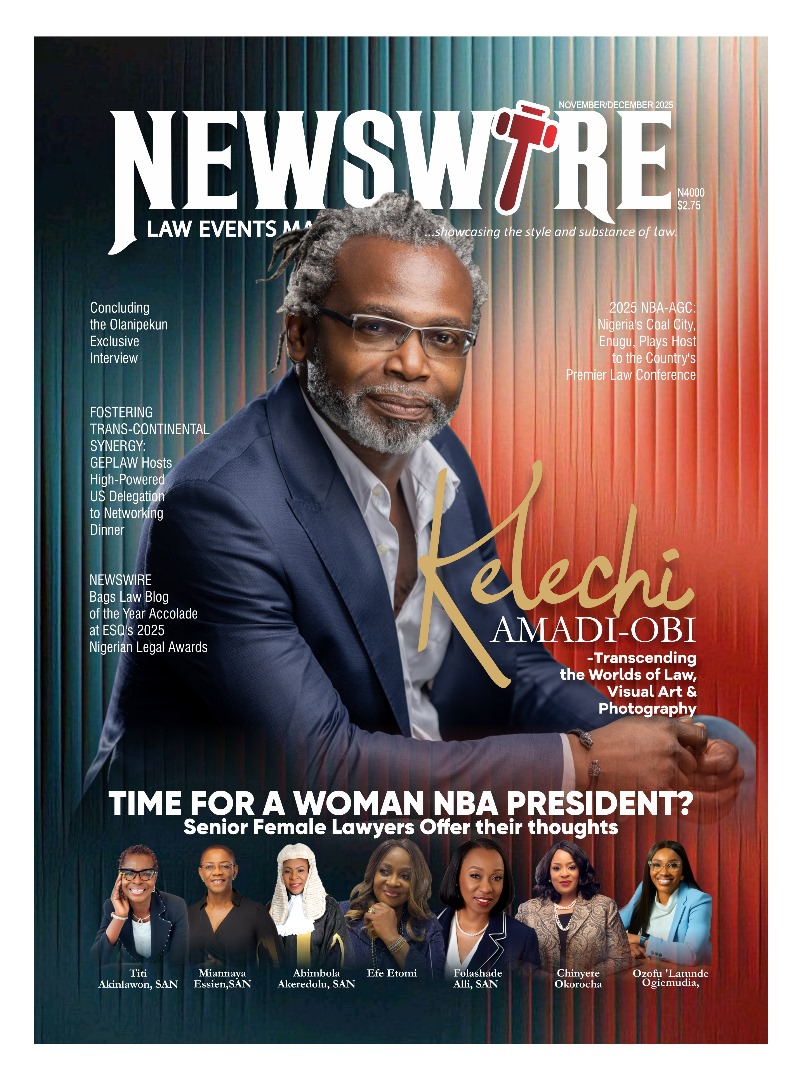

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk