Bitcoin Sinks below $15,000, just Hours after Taking out $17,000

Bitcoin fell from its all-time high on Friday, sliding below $15,000 just hours after blasting through the $17,000 barrier in a more-than-20% one-day rally.

The cryptocurrency BTCUSD, -6.31% on Friday morning tumbled 11% to trade at $14,978.74 on CoinDesk, trimming its weekly gain to a still staggering 38%. The pullback comes after bitcoin on Thursday took out the $15,000, $16,000 and $17,000 milestones in one trading session, sending it up more than 1600% for 2017 year-to-date.

“We do believe that there is something tangible in the demand for cryptocurrencies and over the years ahead there may well be more and more desire for alternative mediums of exchange,” said Jim Reid, strategist at Deutsche Bank, in a note.

“If and when inflation does take off central banks are unlikely to be able to control it given the need to instead control the excessive debt burden most countries face. So we could end up with a situation where the current crypto surge is one of the biggest bubbles in history but still see a cryptocurrency emerge as a long term success story. Interesting times,” he added.

The recent remarkable leg up for bitcoin started in late November, having traded below $5,000 as recent as October. Analysts said the recent announcements that several exchanges will begin to offer bitcoin futures later in December has helped attract the massive new inflows.

CBOE Global Markets CBOE, +0.63% is set to launch a bitcoin futures contract on Sunday, while CME Group CME, -0.01% will launch its contract on Dec. 18. The launch, however, has met pushback from futures brokers, with an industry group this week sending a letter to the Commodity Futures Trading Commission arguing that the contracts should have been more thoroughly vetted.

Futures are seen as potentially further legitimizing bitcoin as an investment, and they could drive additional demand. Some strategists believe the ability to hedge in the futures market will make bitcoin much more attractive to institutional investors, leading to more orderly bitcoin trading.

However, others argue that those same institutional investors could destabilize the bitcoin market by taking on large positions to try to leverage discrepancies in pricing and start to short the cryptocurrency.

“I’m not sure that traders will be particularly deterred by what’s happened this morning, although again, bitcoin is extremely difficult to predict and doesn’t exactly move in a logical manner,” said Craig Erlam, senior market analyst at Oanda, in a note.

“I do wonder whether the launching of bitcoin futures on Sunday is driving people to lock in profits on the expectation or fear of large short positions being accumulated,” he added.

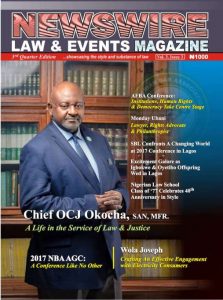

Subscribe for the new edition now

Do you need to be heard? Or your articles published? Send your views, messages, articles or press release to: newswiremagazine@yahoo.co.uk >>> We can cover your (LAW) events at the first Call: 08039218044, 08024004726

-Advertisement-

Grab our latest Magazine, "Chief Wole Olanipekun, CFR, SAN, A man of wide horizons and deep intentions". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did