Banks’ Non-performing Loans rise by 50% to N2.4tn, Oil Sector has Highest Exposure

According to data from the Nigeria Deposit Insurance Corporation (NDIC), the economic challenges in the country made the level of non-performing loans (NPLs) in the Deposit Money Banks (DMBs) to rise by 50 per cent from N1.639tn in December 2016 to N2.424tn by September this year.

The CBN’s non-performing loans ratio in the banking industry is five per cent, but the banks’ NPLs have moved from 10.13 per cent to 15.18 per cent within the period, the financial returns of the DMBs compiled by the NDIC revealed. According to the NDIC data, the NPLs grew from N1.639tn in December 2016 to N1.921tn in March 2017, declining to N1.880tn in June but rising to N2.424tn in September this year.

The Director, Banking Examination Department, NDIC, Mr. Adedapo Adeleke, said that the Financial Stability Report issued by the CBN as of December 31, 2016 indicated a disproportionate credit allocation to the oil and gas sub-sector by the Nigerian banks. “Sectoral allocation to the oil and gas as of December 31, 2016 was 29.59 per cent,” he said.

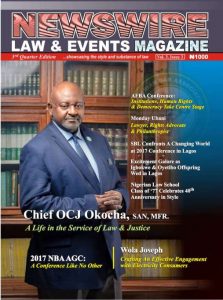

Subscribe for the new edition now

Do you need to be heard? Or your articles published? Send your views, messages, articles or press release to: newswiremagazine@yahoo.co.uk >>> We can cover your (LAW) events at the first Call: 08039218044, 08024004726

-Advertisement-

Grab our latest Magazine, "Chief Wole Olanipekun, CFR, SAN, A man of wide horizons and deep intentions". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk