N1.2bn Tax Error Claim: FIRS, Lawyer Consider Out-of-Court Settlement

The parties in a suit of alleged NI.2 billion tax error claims before the Tax Appeal Tribunal, Abuja on Wednesday agreed to explore an out-of-court settlement.

The appellant, Joseph Daudu, a senior advocate of Nigeria, is challenging the alleged N1.2 billion error in his taxation by the Federal Inland Revenue Service (FIRS).

At the resumed hearing, the counsel to the appellant, Adedayo Adedeji, tendered an application which contained the details of options of settlement.

Mr Adedeji, however, told the tribunal that the hearing could still go on if the respondent rejected the options of settlement thereof.

He also confirmed the presence of his witness, an auditor whom the tribunal directed at the last adjourned date to appear before it to give evidence about the appellant’s financial statement and be cross-examined.

The tribunal chairman, Alice Iriogbe, in her response told the parties to key into the out-of-court settlement option and carry the tribunal along with their plans.

She, therefore, adjourned to April 22 for a report of settlement or continuation of hearing in the event of a breakdown in the negotiation process.

News Agency of Nigeria (NAN) reports that the appellant dragged the FIRS before the tribunal over an allegation of an error on assessments of his Withholding Tax (WHT), Personal Income Tax and Value Added Tax (VAT) for the period from 2010 to 2017.

Specifically, he expressed dissatisfaction with the decision to assess him with respect to WHT and VAT in the sum of N1. 2 billion.

The appellant claimed that it was a misnomer for him, who operated a law firm as a legal practitioner and did not deal in primary goods, to be assessed on Withholding Tax (WHT).

FIRS in its argument said that its assessments were not in error and that it was discovered that the appellant did not deduct and remit WHT on some of the expenses and payments made under the period in review.

The service, therefore, prayed the tribunal to declare that the notices of assessments issued on the appellant for 2010 to 2017 assessment was right.

It also urged the tribunal for an order mandating the appellant to pay the total sum of N1.2 billion, being the appellant’s liability for WHT, personal income tax and VAT for 2010 to 2017 years of assessment.

FIRS stated that it rightly assessed the appellant; acting in accordance with the law and by collaborating with EFCC on non-declaration of income as well as tax evasion

Deji Sasegbon’s Latest Dictionary: Place your order now. Call:08076095047, 07036688678, 08035629991

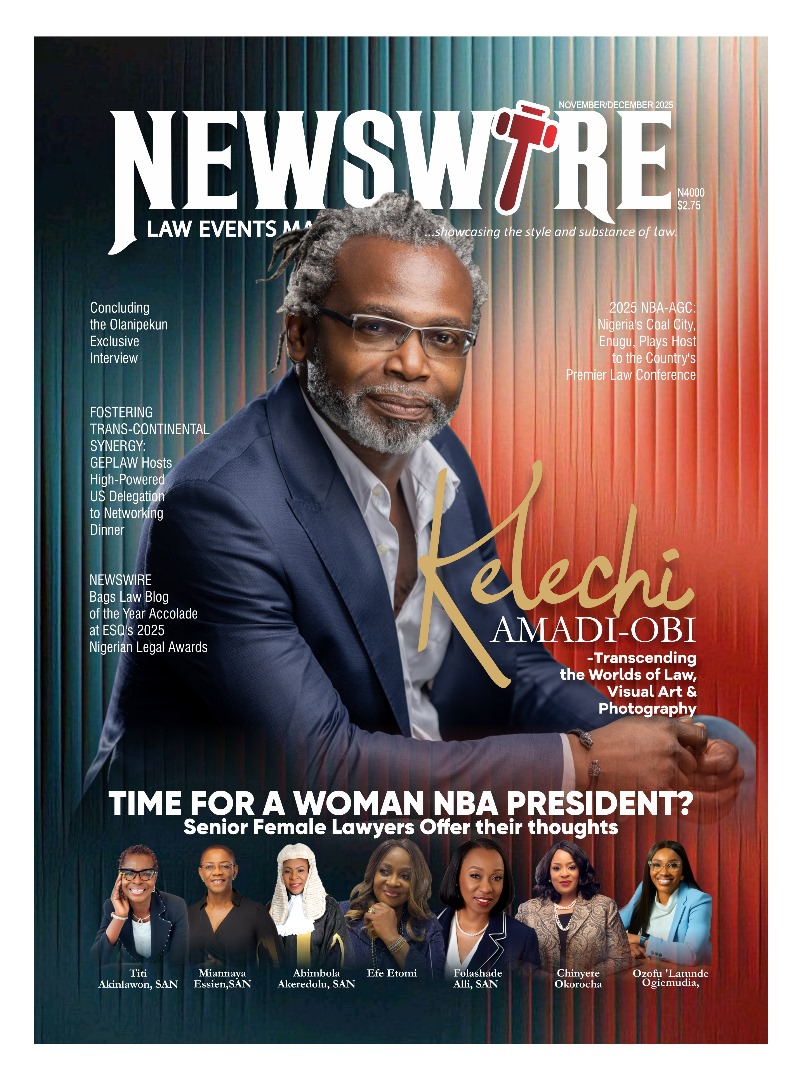

Newswire, we present the world of law and the issues that engage them. This edition is yet again, ‘Mind-blowing’. Go get your copy(ies) Now!

Do you need to be heard? Or your articles published? Send your views, messages, articles or press release to: newswiremagazine@yahoo.co.uk >>> We can cover your (LAW) events at the first Call: 08039218044, 08024004726

-Advertisement-

Grab our latest Magazine, "Kelechi Amadi-Obi - Transcending the worlds of Law, Visual Art and Photography". Get your order fast and stress free.

For more details about Newswire Law&Events Magazine, kindly reach out to us on 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk. You will be glad you did

Download E-MagazineDo you want to be heard, your events covered, your articles published, or need to advertise your products and services on our Blog and Magazine, reach out to us at Newswire Law and Events, you will be glad you did. For more details about our services, please call: 08039218044, 09070309355. Email: newswiremagazine@yahoo.co.uk